Question: first drop down is (less,more) second drop down is (less,greater) (Bond valuation) Bank of America has bonds that pay a coupon interest rate of 6.5

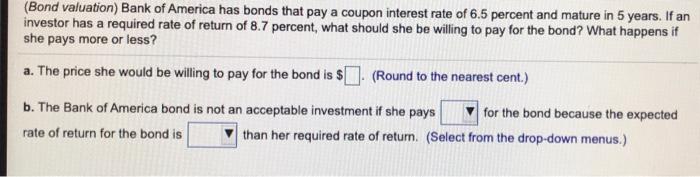

(Bond valuation) Bank of America has bonds that pay a coupon interest rate of 6.5 percent and mature in 5 years. If an investor has a required rate of return of 8.7 percent, what should she be willing to pay for the bond? What happens if she pays more or less? a. The price she would be willing to pay for the bond is $. (Round to the nearest cent.) b. The Bank of America bond is not an acceptable investment if she pays for the bond because the expected rate of return for the bond is than her required rate of return. (Select from the drop-down menus.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts