Question: which is the right formula to use to solve the problem? Blue Star Airlines is considering a three-year charter agreement with Adventure Leisure to transport

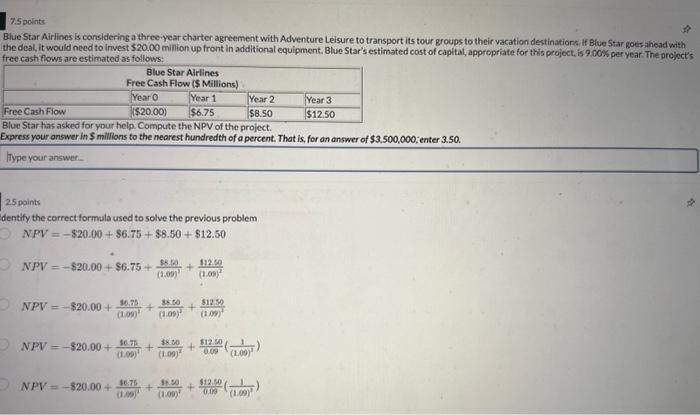

Blue Star Airlines is considering a three-year charter agreement with Adventure Leisure to transport its tour groups to their vacation destinations. If Blue Star goes ahead with the deal, it would need to invest 520.00 million up front in additional equipment. Blue Star's estimated cost of capital, appropriate for this project, is 9.000 per year. The project's free cash flows are estimated as follows: Bive star nas askedror your neip compute the Npv of the project. Express your answer in $ mililions to the nearest hundredth of a percent. That is, for an answer of $3,500,000; enter 3.50 . Itype your answer. 2.5 points dentify the correct formula used to solve the previous problem NPV=$20.00+$6.75+$8.50+$12.50NPV=$20.00+$6.75+(1.00)282.3+(1.06)2112.60NPV=$20.00+(1.09)236.25+(1.09)23s50+(1.00)2312.50NPV=$20.00+(1.00)1$6.7+(1.09)238.60+0.00312.50((1.09)21)NPV=520.00+(1.09)236.75+(1.00)23.00+0.09312.50((1.09)21)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts