Question: First drop down options: 25,317, 27,519, 22,015, 20,914 2nd drop-down options: bonus, straight line 3. Analysis of an expansion project Companies invest in expansion projects

First drop down options: 25,317, 27,519, 22,015, 20,914

First drop down options: 25,317, 27,519, 22,015, 20,914

2nd drop-down options: bonus, straight line

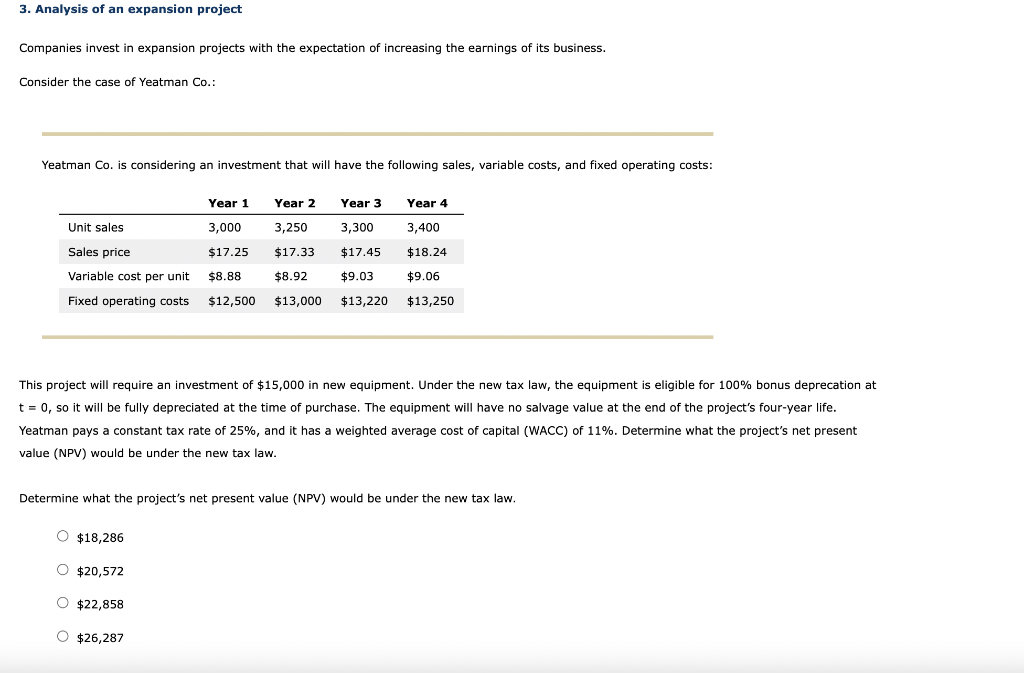

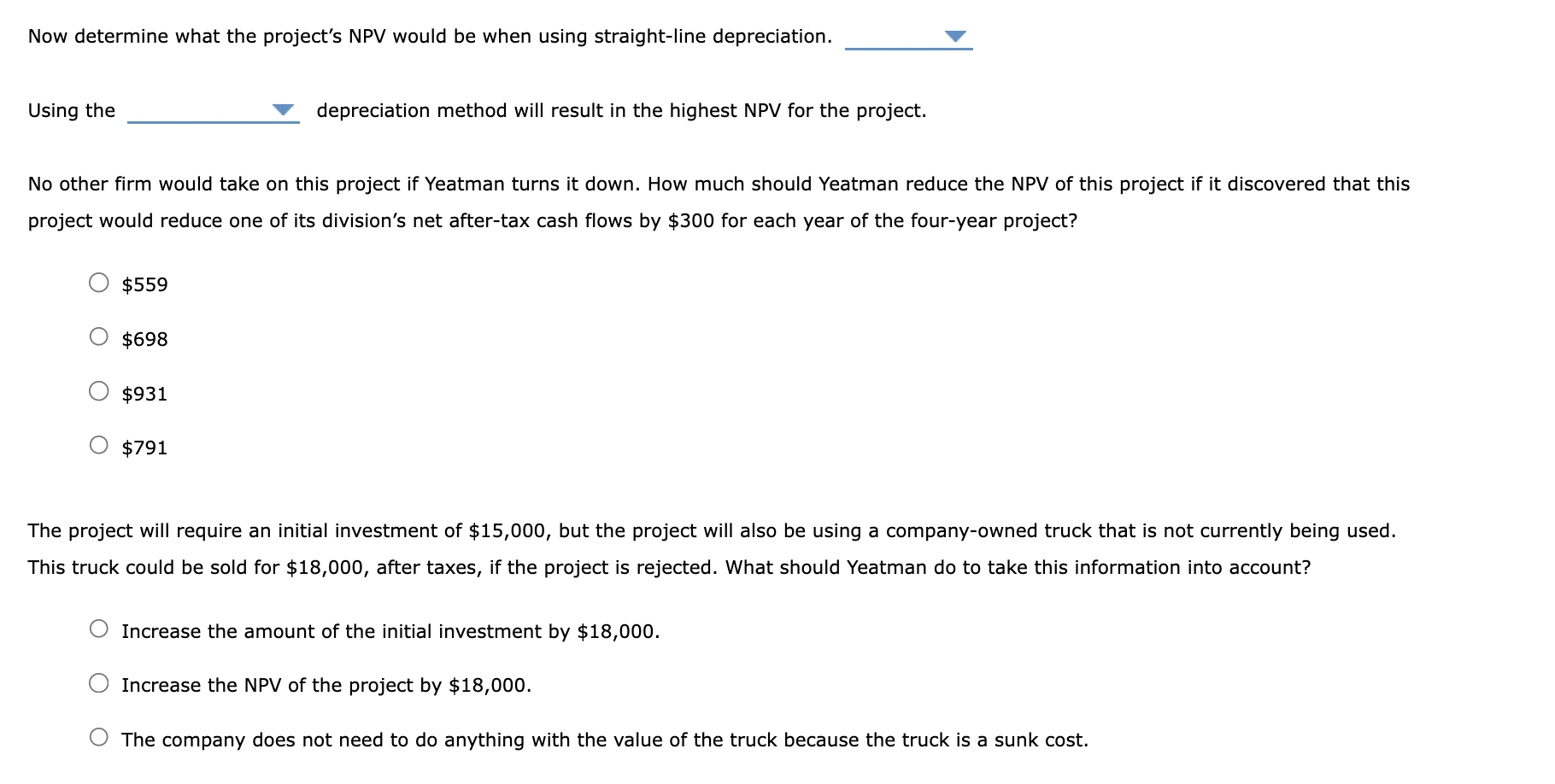

3. Analysis of an expansion project Companies invest in expansion projects with the expectation of increasing the earnings of its business. Consider the case of Yeatman Co.: Yeatman Co. is considering an investment that will have the following sales, variable costs, and fixed operating costs: This project will require an investment of $15,000 in new equipment. Under the new tax law, the equipment is ation at t=0, so it will be fully depreciated at the time of purchase. The equipment will have no salvage value at the end of the project's four-year life. Yeatman pays a constant tax rate of 25%, and it has a weighted average cost of capital (WACC) of 11%. Determine what the projects net present value (NPV) would be under the new tax law. Determine what the project's net present value (NPV) would be under the new tax law. $18,286 $20,572$22,858 $26,287 Now determine what the project's NPV would be when using straight-line depreciation. Using the depreciation method will result in the highest NPV for the project. project would reduce one of its division's net after-tax cash flows by $300 for each year of the four-year project? $559 $698 $931 $791 This truck could be sold for $18,000, after taxes, if the project is rejected. What should Yeatman do to take this information into account? Increase the amount of the initial investment by $18,000. Increase the NPV of the project by $18,000. The company does not need to do anything with the value of the truck because the truck is a sunk cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts