Question: Life-cycle costing. New Life Metal Recycling and Salvage has just been given the opportunity to salvage scrap metal and other materials from an old industrial

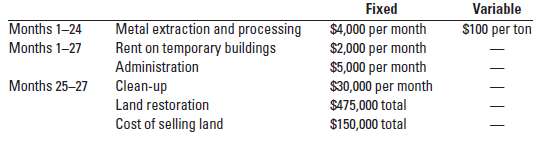

Life-cycle costing. New Life Metal Recycling and Salvage has just been given the opportunity to salvage scrap metal and other materials from an old industrial site. The current owners of the site will sign over the site to New Life at no cost. New Life intends to extract scrap metal at the site for 24 months, and then will clean up the site, return the land to useable condition, and sell it to a developer. Projected costs associated with the project follow:

Ignore time value of money.Required1. Assuming that New Life expects to salvage 50,000 tons of metal from the site, what is the total project life cycle cost?2. Suppose New Life can sell the metal for $150 per ton and wants to earn a profit (before taxes) of $40 per ton.At what price must New Life sell the land at the end of the project to achieve its target profit per ton?3. Now suppose New Life can only sell the metal for $140 per ton and the land at $100,000 less than what you calculated in requirement 2. If New Life wanted to maintain the same mark-up percentage on total project life-cycle cost as in requirement 2, by how much would it have to reduce its total project life-cyclecost?

Variable $100 per ton Fixed $4,000 per month $2,000 per month $5,000 per month $30,000 per month $475,000 total $150,000 total Metal extraction and processing Rent on temporary buildings Administration Clean-up Land restoration Cost of selling land Months 1-24 Months 1-27 Months 25-27

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Lifecycle costing 1 Total Project LifeCycle Costs Variable costs Metal extraction and processing 100 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

58-B-M-A-C-B (140).docx

120 KBs Word File