Question: First gather the relevant data by completing the following table. Present Value: Period: Rate of Interest: Future Value Factor: % Next use the following table

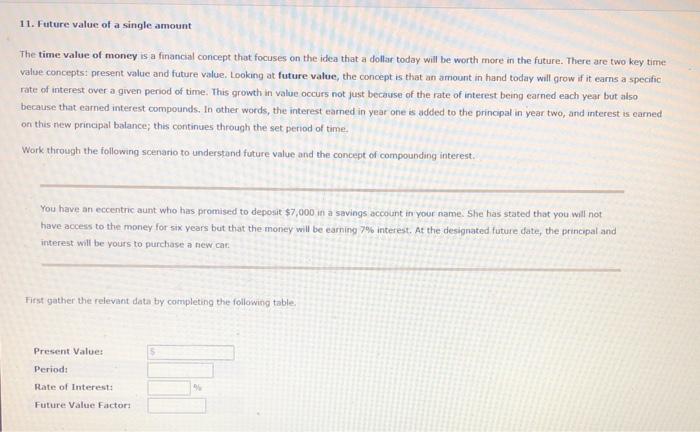

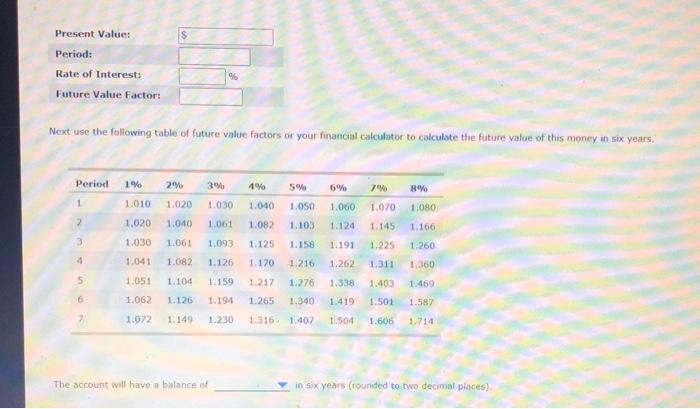

First gather the relevant data by completing the following table. Present Value: Period: Rate of Interest: Future Value Factor: % Next use the following table of future value factors or your financial calculator to calculate the future value of this money in six years. Period 1% 2% 3% 4% 5% 6% 7% 8% 1 1.020 1.030 1.040 1.050 1.060 1.070 1.080 1,010 1.020 2 1.040 1.061 1.082 1.103 1.124 1.145 1.166 3 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.041 1.082 1 126 1.170 1.216 1.262 1311 1.250 1.360 1.469 1:587 5 1.051 1.104 1159 1.217 1.276 1.338 1.403 6 1.062 1.126 1.194 1.265. 1.340 1.419 1.501 7 1.072 1.149 1.230 1.316 1:407 1.504 1.606 1.714 The account will have a balance of six years rounded to two decimal places) 11. Future value of a single amount The time value of money is a financial concept that focuses on the idea that a dollat today will be worth more in the future. There are two key time value concepts: present value and future value. Looking at future value, the concept is that an amount in hand today will grow if it earns a specific rate of interest over a given period of time. This growth in value occurs not just because of the rate of interest being earned each year but also because that earned interest compounds. In other words, the interest eamed in year one is added to the principal in year two, and interest is earned on this new principal balance; this continues through the set period of time, Work through the following scenario to understand future value and the concept of compounding interest You have an eccentric aunt who has promised to deposit $7,000 in a savings account in your name. She has stated that you will not have access to the money for six years but that the money will be earning 7% interest. At the designated future date, the cipal and interest will be yours to purchase a new car First gather the relevant data by completing the following table Present Values Period: Ini Rate of Interests Future Value Factor Present Value: Period: 96 Rate of Interest: Future Value Factor: Next use the following table of future value factors or your financial calculator to calculate the future value of this money in six years. Period 1% 296 3% 4 5% 7% 8% 1 1.010 1.030 1.050 1.060 1.070 1.080 1.020 1.040 1.040 1.082 2 1,020 1.061 1.103 1.124 1.145 1.166 1.260 3 1.030 1.061 1.093 1.125 1.158 1.191 1.225 4 1.082 1.126 1.170 1.216 1.311 1.360 1.041 1.051 1.262 1.338 5 1.104 1.159 1.217 1.276 1.469 1.403 1.501 6 1.062 1.126 1.194 1.265 1.340 1.419 1.587 7 1.072 1.149 1.230 1.316 1.407 1.504 1.606 1.714 The account will have a balance of in six years (rounded to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts