Question: First image is the question and the rest are the answer options Question 3 1 pts If bonds with a face value of $750,000 and

First image is the question and the rest are the answer options

![January 1st, the journal entry to record the issuance is: [Select] Assuming](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea8c26a9418_33466ea8c2617f37.jpg)

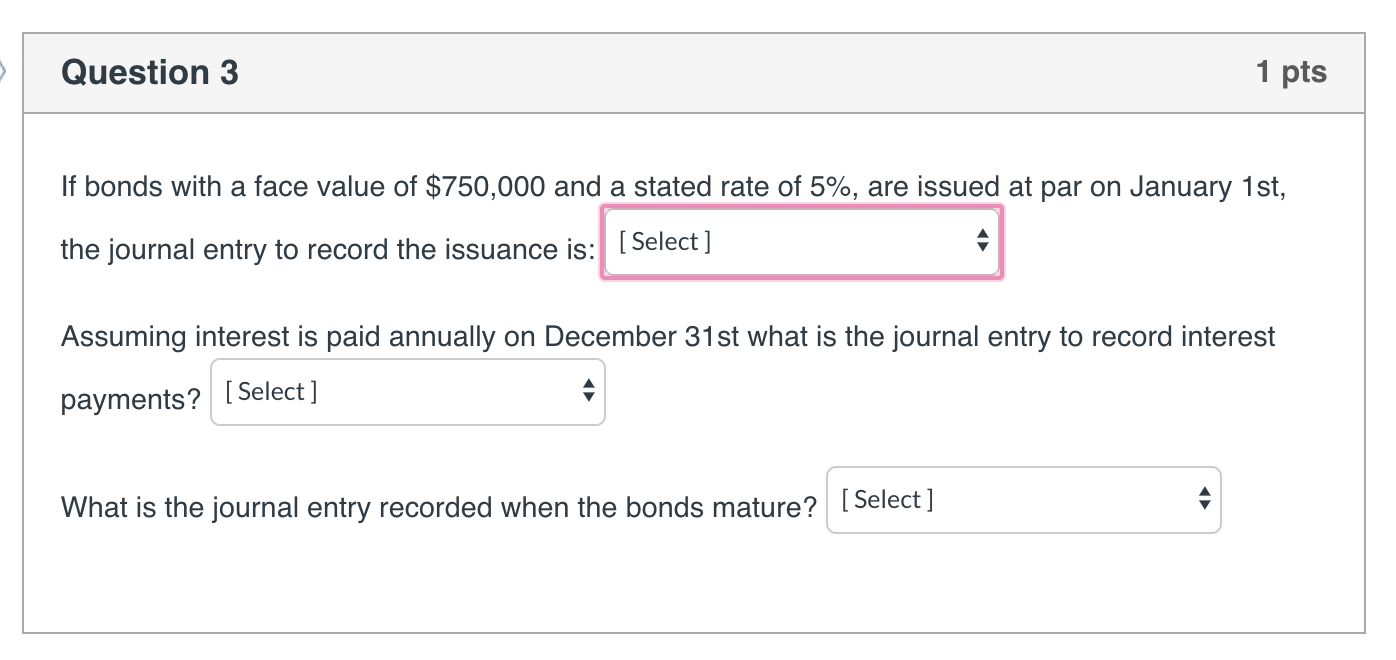

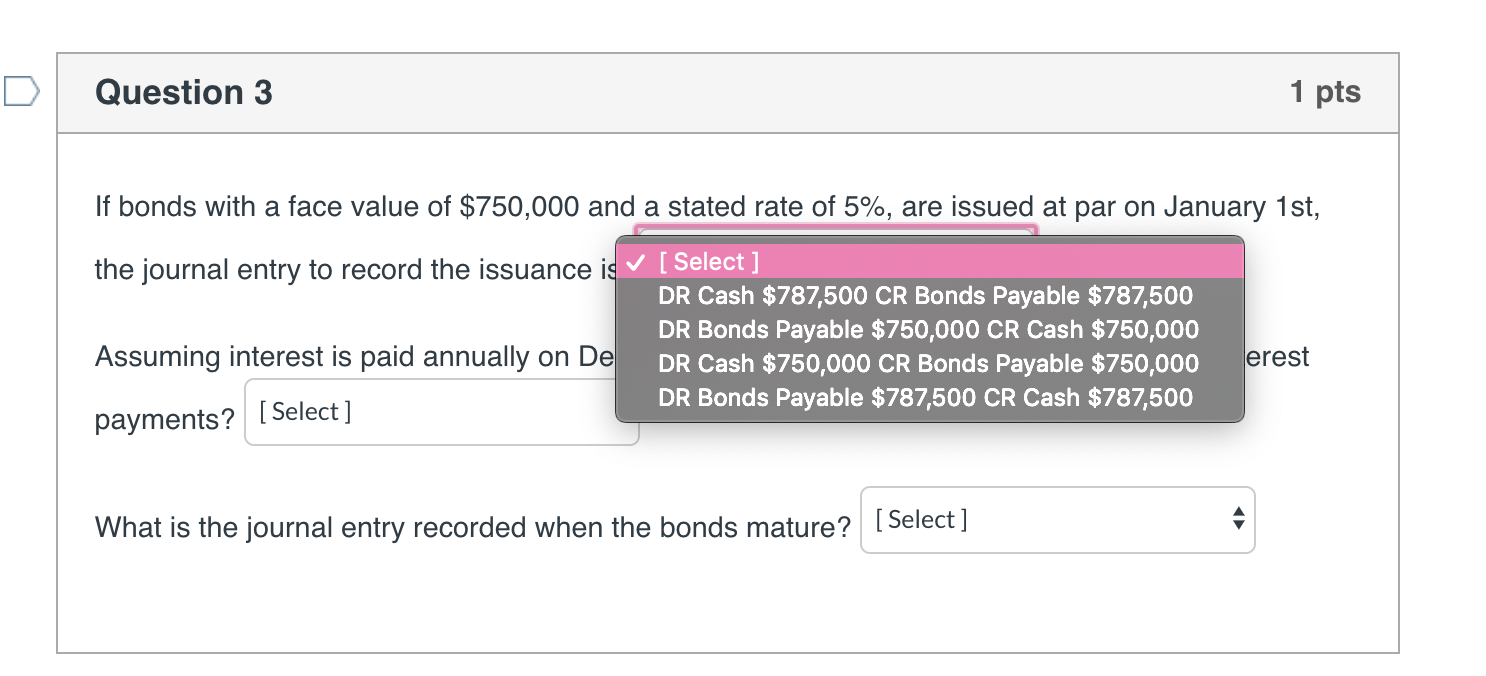

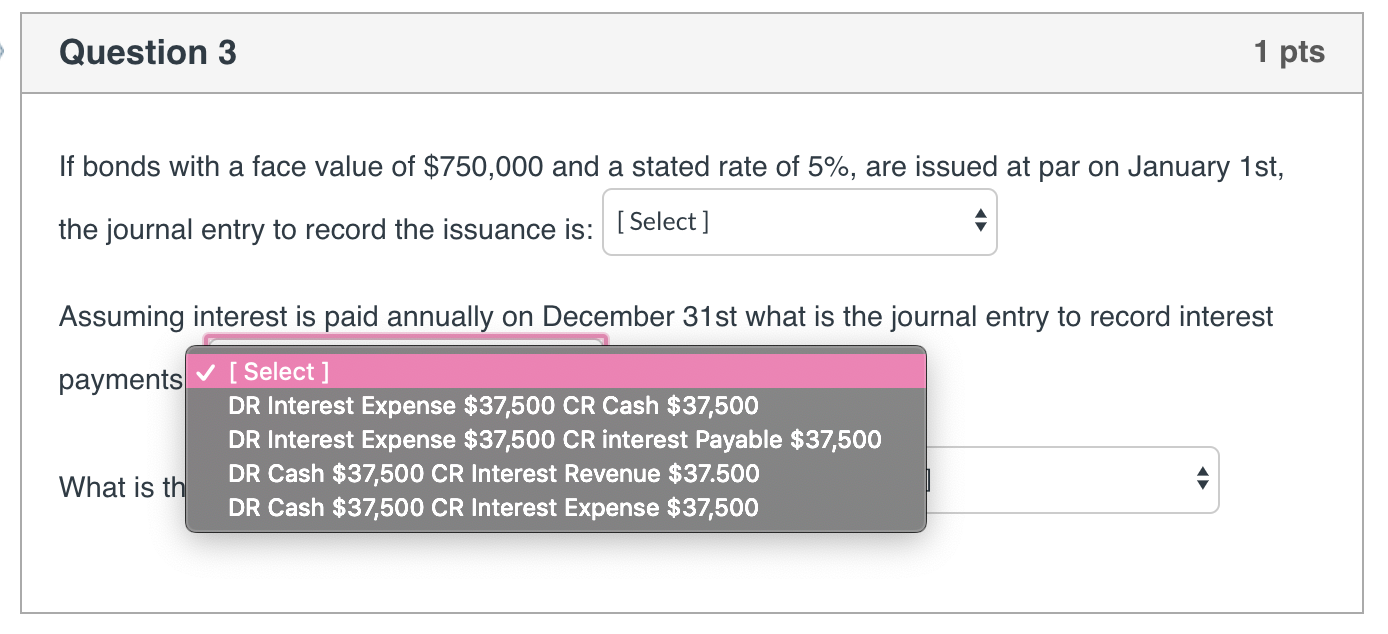

Question 3 1 pts If bonds with a face value of $750,000 and a stated rate of 5%, are issued at par on January 1st, the journal entry to record the issuance is: [Select] Assuming interest is paid annually on December 31st what is the journal entry to record interest payments? [Select] What is the journal entry recorded when the bonds mature? [Select] Question 3 1 pts If bonds with a face value of $750,000 and a stated rate of 5%, are issued at par on January 1st, the journal entry to record the issuance is [Select DR Cash $787,500 CR Bonds Payable $787,500 DR Bonds Payable $750,000 CR Cash $750,000 DR Cash $750,000 CR Bonds Payable $750,000 DR Bonds Payable $787,500 CR Cash $787,500 erest Assuming interest is paid annually on De payments? [ Select] What is th nal en ry recorded when the bonds mature? [Select] Question 3 1 pts If bonds with a face value of $750,000 and a stated rate of 5%, are issued at par on January 1st, the journal entry to record the issuance is: [Select] Assuming interest is paid annually on December 31st what is the journal entry to record interest payments [ Select ] DR Interest Expense $37,500 CR Cash $37,500 DR Interest Expense $37,500 CR interest Payable $37,500 What is th DR Cash $37,500 CR Interest Revenue $37.500 DR Cash $37,500 CR Interest Expense $37,500 Question 3 1 pts If bonds with a face value of $750,000 and a stated rate of 5%, are issued at par on January 1st, the journal entry to record the issuance is: [Select] Assuming interest is paid annually on December 31st what is the journal entry to record interest payments? [Select] What is the journal entry recorded when the bonds mature [ Select ] DR Cash $750,000 CR Bonds Payable $750,000 DR Bonds Receivable $750,000 CR Cash $750,000 DR Bonds Payable $750,000 CR Cash $750,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts