Question: first pciture is the question please help with the highlighted areas i must prepare entries A depreciation schedule for construction equipment of Nutella Co was

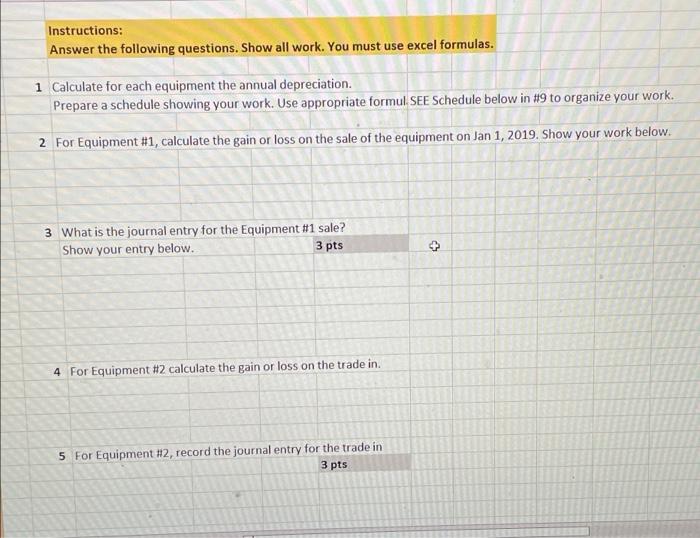

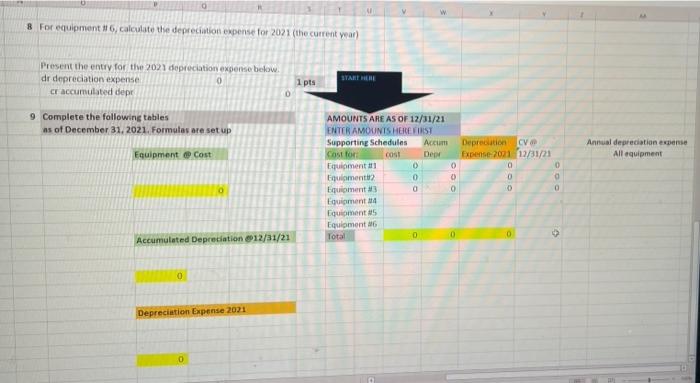

A depreciation schedule for construction equipment of Nutella Co was requested by the controller soon after December 31, 2021, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2018 to 2021, inclusive. The following data were ascertained: Balance of Equipment account, Jan. 1, 2018 Equipment No. 1 purchased Jan. 1, 2015, cost $ 50,000 Equipment No. 2 purchased July 1, 2015, cost 60,000 Equipment No. 3 purchased Jan. 1, 2016, cost 55,000 Equipment No. 4 purchased July 1, 2017, cost 70,000 Depreciation on all pieces of equipment from the respective dates of purchase, based on a 5-year life, no salvage value. 1. Jan. 1, 2019 Equipment No. 1 was sold for $6,000 cash 2. July 1, 2019 Equipment No. 2 was traded for a larger ore (No. 5), the agreed purchase price of which was $80,000. Nutella paid the dealer $66,000 cash on the transaction. 3. July 1, 2020 Equipment No. 3 was damaged in a wreck to such an extent that it was sold as junk for $500 cash. Nutella received $12,000 from the insurance company. 4. July 1, 2021 A new Equipment (No. 6) was acquired for $92,000 cash. Instructions: Answer the following questions. Show all work. You must use excel formulas. 1 Calculate for each equipment the annual depreciation. Prepare a schedule showing your work. Use appropriate formul SEE Schedule below in #9 to organize your work. 2 For Equipment #1, calculate the gain or loss on the sale of the equipment on Jan 1, 2019. Show your work below. 3 What is the journal entry for the Equipment #1 sale? Show your entry below. 3 pts + 4 For Equipment #2 calculate the gain or loss on the trade in. 5 For Equipment #2, record the journal entry for the trade in 3 pts 6 For Equipment #3 calculate the gain/loss on the sale and the receipt of insurance proceeds at 7/1/2020 7 For Equipment #3, prepare the journal entry for the sale and receipt of the insurance proceeds 3 pts 3 8 For equipment #16, calculate the depreciation expense for 2021 (the current year) Present the entry for the 2021 depreciation expense below dr depreciation expenses 0 cr accumulated depe 1 pts START HERE 0 9 Complete the following tables as of December 31, 2021. Formulas are set up Annual depreciation expense All equipment Equipment @ Cost AMOUNTS ARE AS OF 12/31/21 ENTER AMOUNTS HERE FIRST Supporting Schedules Acum Cost for COS! Depr Equiment 0 Equipment 0 Equipment 0 Equipment 14 Equipment #5 Equipment 16 Total Depreciation CV Expense 2021 12/31/21 a 0 0 Accumulated Depreciation 12/31/21 0 Depreciation Expense 2021 O A depreciation schedule for construction equipment of Nutella Co was requested by the controller soon after December 31, 2021, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2018 to 2021, inclusive. The following data were ascertained: Balance of Equipment account, Jan. 1, 2018 Equipment No. 1 purchased Jan. 1, 2015, cost $ 50,000 Equipment No. 2 purchased July 1, 2015, cost 60,000 Equipment No. 3 purchased Jan. 1, 2016, cost 55,000 Equipment No. 4 purchased July 1, 2017, cost 70,000 Depreciation on all pieces of equipment from the respective dates of purchase, based on a 5-year life, no salvage value. 1. Jan. 1, 2019 Equipment No. 1 was sold for $6,000 cash 2. July 1, 2019 Equipment No. 2 was traded for a larger ore (No. 5), the agreed purchase price of which was $80,000. Nutella paid the dealer $66,000 cash on the transaction. 3. July 1, 2020 Equipment No. 3 was damaged in a wreck to such an extent that it was sold as junk for $500 cash. Nutella received $12,000 from the insurance company. 4. July 1, 2021 A new Equipment (No. 6) was acquired for $92,000 cash. Instructions: Answer the following questions. Show all work. You must use excel formulas. 1 Calculate for each equipment the annual depreciation. Prepare a schedule showing your work. Use appropriate formul SEE Schedule below in #9 to organize your work. 2 For Equipment #1, calculate the gain or loss on the sale of the equipment on Jan 1, 2019. Show your work below. 3 What is the journal entry for the Equipment #1 sale? Show your entry below. 3 pts + 4 For Equipment #2 calculate the gain or loss on the trade in. 5 For Equipment #2, record the journal entry for the trade in 3 pts 6 For Equipment #3 calculate the gain/loss on the sale and the receipt of insurance proceeds at 7/1/2020 7 For Equipment #3, prepare the journal entry for the sale and receipt of the insurance proceeds 3 pts 3 8 For equipment #16, calculate the depreciation expense for 2021 (the current year) Present the entry for the 2021 depreciation expense below dr depreciation expenses 0 cr accumulated depe 1 pts START HERE 0 9 Complete the following tables as of December 31, 2021. Formulas are set up Annual depreciation expense All equipment Equipment @ Cost AMOUNTS ARE AS OF 12/31/21 ENTER AMOUNTS HERE FIRST Supporting Schedules Acum Cost for COS! Depr Equiment 0 Equipment 0 Equipment 0 Equipment 14 Equipment #5 Equipment 16 Total Depreciation CV Expense 2021 12/31/21 a 0 0 Accumulated Depreciation 12/31/21 0 Depreciation Expense 2021 O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts