Question: First photo has the exercise, second photo is the question, and third photo is excel template for answers. EB 7. LO 11.3 Kenzie purchased a

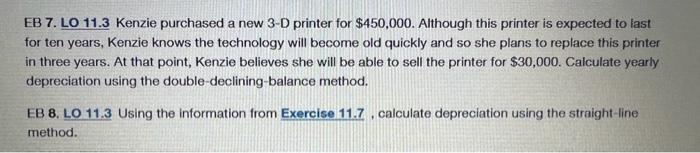

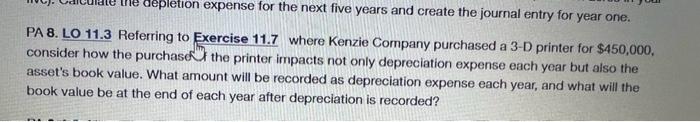

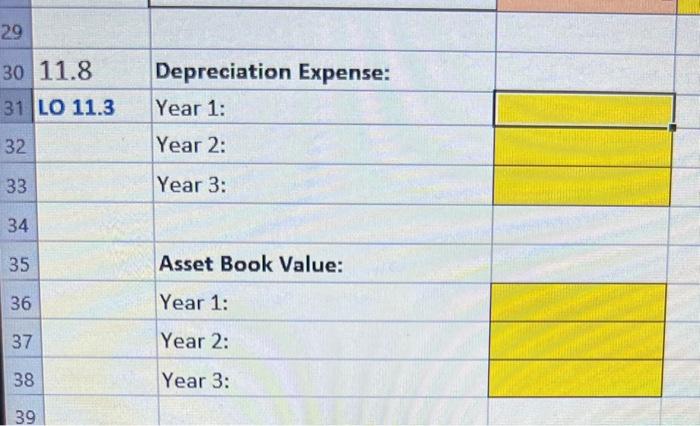

EB 7. LO 11.3 Kenzie purchased a new 3-D printer for $450,000. Although this printer is expected to last for ten years, Kenzie knows the technology will become old quickly and so she plans to replace this printer in three years. At that point, Kenzie believes she will be able to sell the printer for $30,000. Calculate yearly depreciation using the double-declining-balance method. EB 8, LO 11.3 Using the information from Exercise 11.7 , calculate depreciation using the straight-line method. PA 8. LO 11.3 Referring to Exercise 11.7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchasd the printer impacts not only depreciation expense each year but also the asset's book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded? Depreciation Expense: Year 1: Year 2: Year 3: Asset Book Value: Year 1: Year 2: Year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts