Question: first picture are the instructions w/ an example. second picture are the numbers i will be using to solve question A and B and green

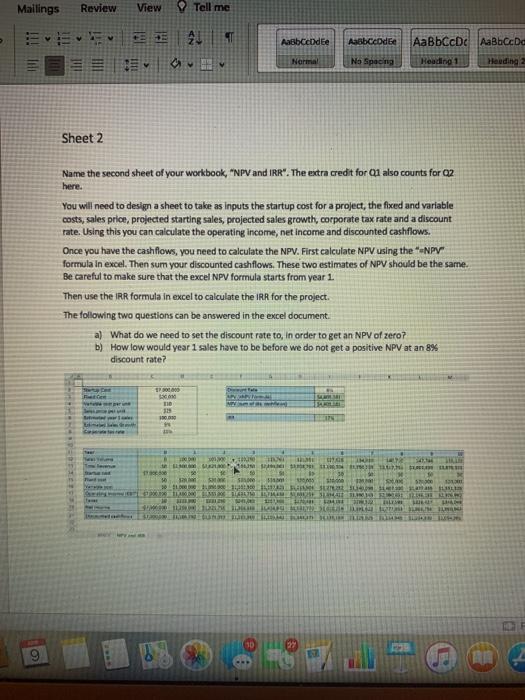

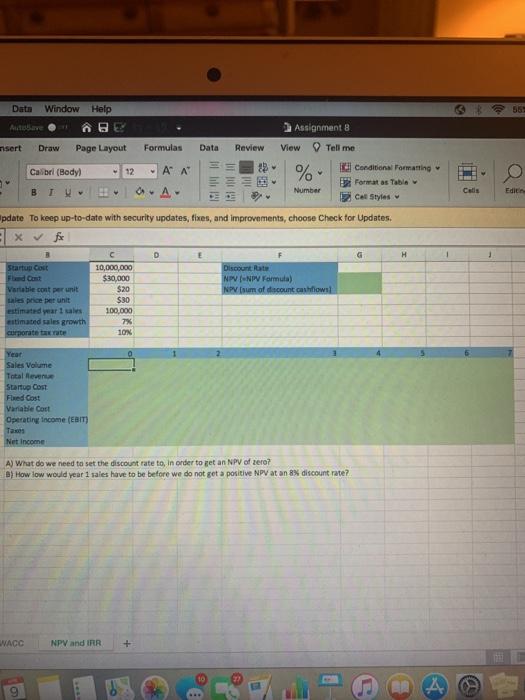

Mailings Review View Tell me Aasbe dee Aasbecode AaBbacDc AaBb CcDo BEM w Normal No Spacing Heading 1 Heading 2 Sheet 2 Name the second sheet of your workbook, "NPV and IRR". The extra credit for 1 also counts for Q2 here. You will need to design a sheet to take as inputs the startup cost for a project, the fixed and variable costs, sales price, projected starting sales, projected sales growth, corporate tax rate and a discount rate. Using this you can calculate the operating income, net income and discounted cashflows. Once you have the cashflows, you need to calculate the NPV. First calculate NPV using the "-NPY" formula in excel. Then sum your discounted cashflows. These two estimates of NPV should be the same. Be careful to make sure that the excel NPV formula starts from year 1. Then use the IRR formula in excel to calculate the IRR for the project. The following two questions can be answered in the excel document. a) What do we need to set the discount rate to, in order to get an NPV of zero7 b) How low would year 1 sales have to be before we do not get a positive NPV at an 8% discount rate? 17 000 COM TID 19 . RAMON BURE SO 30 10 10 LAATTI DE ILUM 30 27 Mailings Review View Tell me Aasbe dee Aasbecode AaBbacDc AaBb CcDo BEM w Normal No Spacing Heading 1 Heading 2 Sheet 2 Name the second sheet of your workbook, "NPV and IRR". The extra credit for 1 also counts for Q2 here. You will need to design a sheet to take as inputs the startup cost for a project, the fixed and variable costs, sales price, projected starting sales, projected sales growth, corporate tax rate and a discount rate. Using this you can calculate the operating income, net income and discounted cashflows. Once you have the cashflows, you need to calculate the NPV. First calculate NPV using the "-NPY" formula in excel. Then sum your discounted cashflows. These two estimates of NPV should be the same. Be careful to make sure that the excel NPV formula starts from year 1. Then use the IRR formula in excel to calculate the IRR for the project. The following two questions can be answered in the excel document. a) What do we need to set the discount rate to, in order to get an NPV of zero7 b) How low would year 1 sales have to be before we do not get a positive NPV at an 8% discount rate? 17 000 COM TID 19 . RAMON BURE SO 30 10 10 LAATTI DE ILUM 30 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts