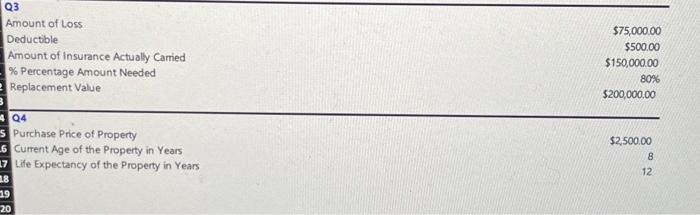

Question: First Picture is the info sheet the second picture is the questions. Q3 Amount of Loss Deductible Amount of Insurance Actualy Carried % Percentage Amount

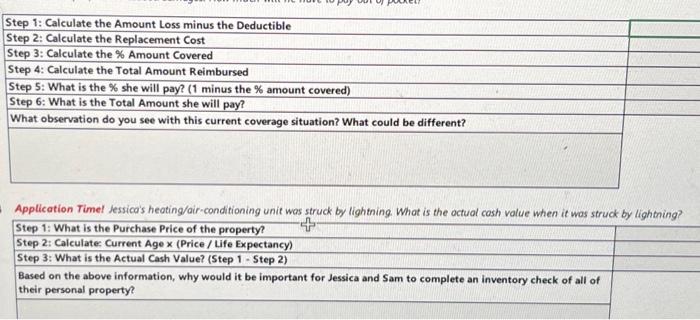

Q3 Amount of Loss Deductible Amount of Insurance Actualy Carried % Percentage Amount Needed Replacement Value Q4 Purchase Price of Property Current Age of the Property in Years Life Expectancy of the Property in Years $75,000,00 $500.00 $150,000.00 80% $200,000,00 $2,500.00 8 12 \begin{tabular}{|l|l|} \hline Step 1: Calculate the Amount Loss minus the Deductible \\ \hline Step 2: Calculate the Replacement Cost \\ \hline Step 3: Calculate the \% Amount Covered \\ \hline Step 4: Calculate the Total Amount Reimbursed \\ \hline Step 5: What is the \% she will pay? (1 minus the \% amount covered) \\ \hline Step 6: What is the Total Amount she will pay? \\ \hline What observation do you see with this current coverage situation? What could be different? \\ \hline & \\ \hline \end{tabular} Application Timel Jessica's heating/air-conditioning unit was struck by lightning. Whot is the octual cash value when it wos struck by lightning? \begin{tabular}{l} Step 1: What is the Purchase Price of the property? \\ \hline Step 2: Calculate: Current Age x (Price / Life Expectancy) \\ \hline Step 3: What is the Actual Cash Value? (Step 1 - Step 2) \\ \hline Based on the above information, why would it be important for Jessica and Sam to complete an inventory check of all of \\ their personal property? \\ \hline \end{tabular} Q3 Amount of Loss Deductible Amount of Insurance Actualy Carried % Percentage Amount Needed Replacement Value Q4 Purchase Price of Property Current Age of the Property in Years Life Expectancy of the Property in Years $75,000,00 $500.00 $150,000.00 80% $200,000,00 $2,500.00 8 12 \begin{tabular}{|l|l|} \hline Step 1: Calculate the Amount Loss minus the Deductible \\ \hline Step 2: Calculate the Replacement Cost \\ \hline Step 3: Calculate the \% Amount Covered \\ \hline Step 4: Calculate the Total Amount Reimbursed \\ \hline Step 5: What is the \% she will pay? (1 minus the \% amount covered) \\ \hline Step 6: What is the Total Amount she will pay? \\ \hline What observation do you see with this current coverage situation? What could be different? \\ \hline & \\ \hline \end{tabular} Application Timel Jessica's heating/air-conditioning unit was struck by lightning. Whot is the octual cash value when it wos struck by lightning? \begin{tabular}{l} Step 1: What is the Purchase Price of the property? \\ \hline Step 2: Calculate: Current Age x (Price / Life Expectancy) \\ \hline Step 3: What is the Actual Cash Value? (Step 1 - Step 2) \\ \hline Based on the above information, why would it be important for Jessica and Sam to complete an inventory check of all of \\ their personal property? \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts