Question: first picture is what i need help with, second is how to do the problem Attempts 0 6. Problem 7.13 (Price And Yield) Keep the

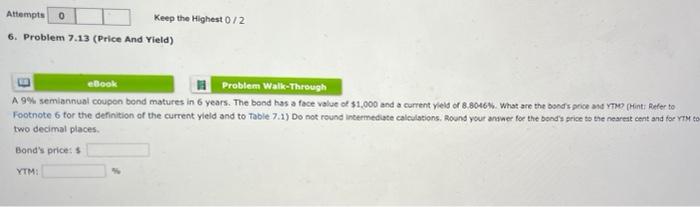

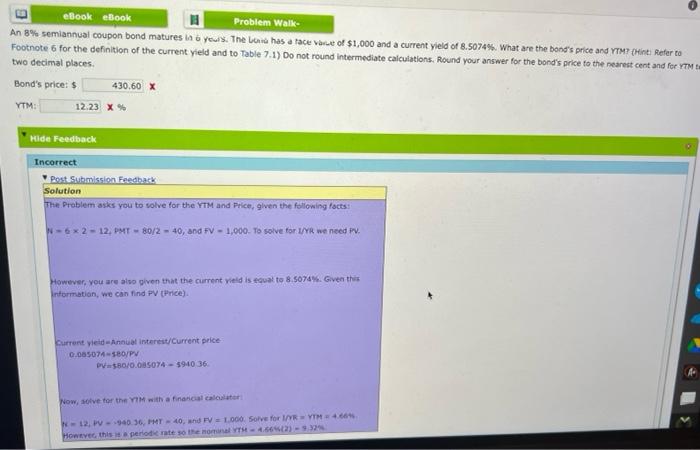

Attempts 0 6. Problem 7.13 (Price And Yield) Keep the Highest 0/2 eBook Problem Walk-Through A 9% semiannual coupon bond matures in 6 years. The bond has a face value of $1,000 and a current yield of 8.8046%. What are the bond's price and YTM? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1) Do not round intermediate calculations. Round your answer for the bond's price to the nearest cent and for YTM to two decimal places. Bond's price: $ YTM: eBook eBook Problem Walk- An 8% semiannual coupon bond matures in 6 years. The band has a face value of $1,000 and a current yield of 8.5074%. What are the bond's price and YTM? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1) Do not round intermediate calculations. Round your answer for the bond's price to the nearest cent and for YTM tw two decimal places. Bond's price: $ YTM: 430.60 X 12.23 X % Hide Feedback Incorrect Post Submission Feedback Solution The Problem asks you to solve for the YTM and Price, given the following facts: N-6x2-12, PMT-80/240, and FV 1,000. To solve for 1/YR we need PV. However, you are also given that the current yield is equal to 8.5074%. Given this Information, we can find PV (Price). Current yield-Annual interest/Current price 0.085074-180/PV PV-180/0.085074-$940 36. Now, solve for the YTM with a financial calculator N-12, PV-940.36, PMT-40, and FV 1.000. Solve for 1/YR YTM 4.66% However, this is a periodic rate so the nominal YTH-4.66%(2)-9.32%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts