Question: First things first, thanks for your answers! Only a few choice questions. Please give the answer as soon as possible. Then l will give you

First things first, thanks for your answers! Only a few choice questions. Please give the answer as soon as possible. Then l will give you a positive rating without hesitance. Thank You!

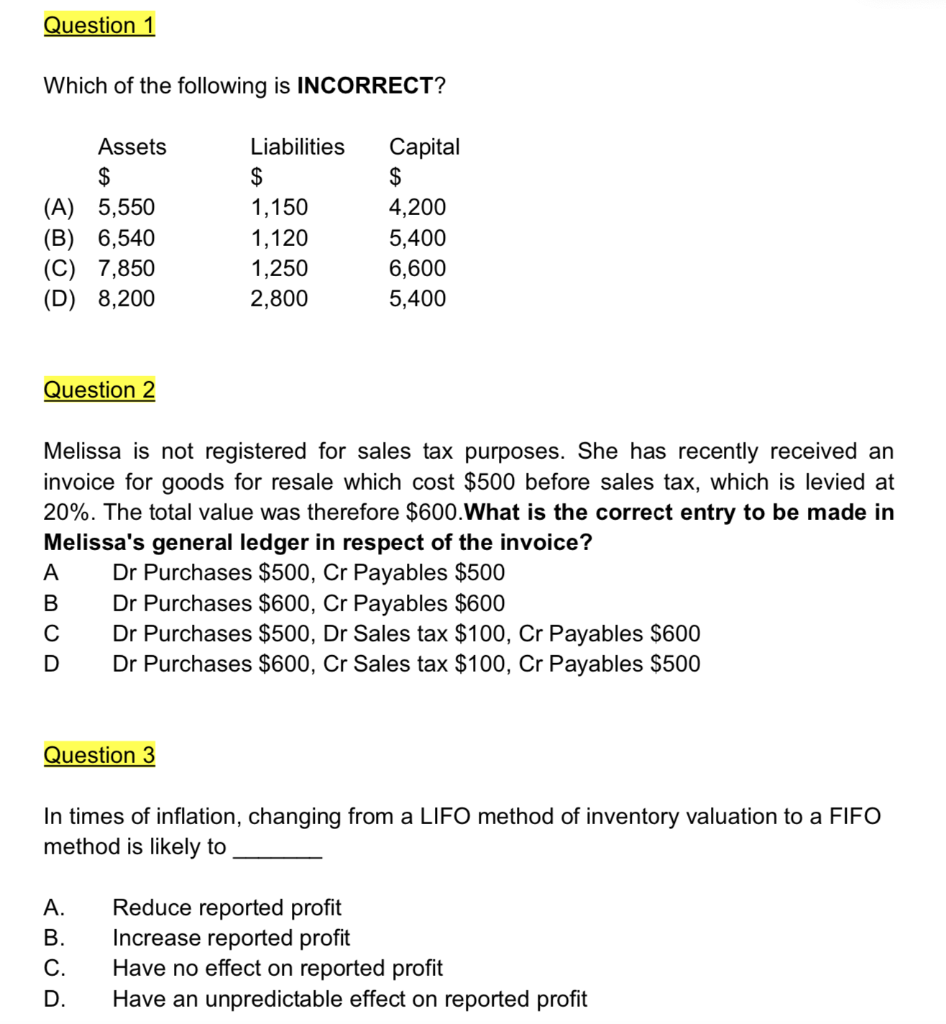

Question 1 Which of the following is INCORRECT? Assets $ (A) 5,550 (B) 6,540 (C) 7,850 (D) 8,200 Liabilities $ 1,150 1,120 1,250 2,800 Capital $ 4,200 5,400 6,600 5,400 Question 2 Melissa is not registered for sales tax purposes. She has recently received an invoice for goods for resale which cost $500 before sales tax, which is levied at 20%. The total value was therefore $600.What is the correct entry to be made in Melissa's general ledger in respect of the invoice? A Dr Purchases $500, Cr Payables $500 B Dr Purchases $600, Cr Payables $600 Dr Purchases $500, Dr Sales tax $100, Cr Payables $600 D Dr Purchases $600, Cr Sales tax $100, Cr Payables $500 Question 3 In times of inflation, changing from a LIFO method of inventory valuation to a FIFO method is likely to A. B. C. D. Reduce reported profit Increase reported profit Have no effect on reported profit Have an unpredictable effect on reported profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts