Question: First time, I am using this hope can help me out for basic understanding. My professor does not lecture even though she knows many things

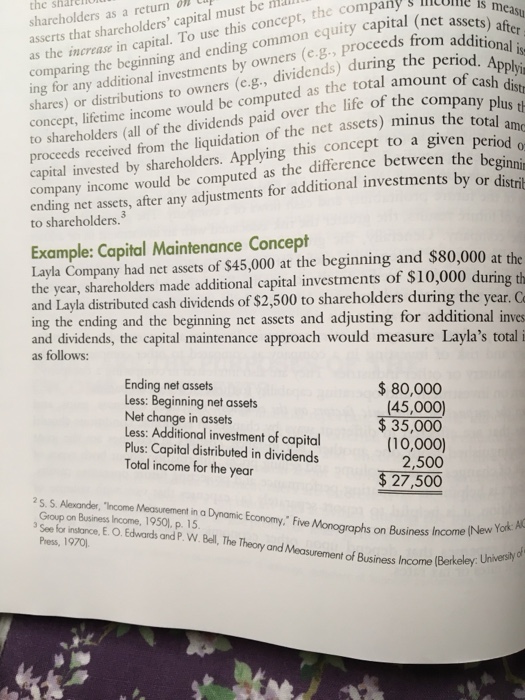

the shalreno asserts that sharcholders' capital must be l as the company cis m the beginning and ending common equity capital (net ases n as the total amount of cash d areholders as a return on the increase in capital. To use this concept, the companyll ompari ing for any additional investn shares) or distributions to owners (e.g., concept, lifetime income would be computed to sharcholders (all of the dividends paid over the life of the company n proceeds received from the liquidation of the net assets) minus the total capital invested by shareholders. Applying this concept to a given period any additional investments by owners (e.g., proceeds fro dividends) during the period, plus t amo ending net assets, after any adjustments for additional investments b to sharcholders.3 mpany income would be computed as the difference between the be ginni rib y or dist Example: Capital Maintenance Concept Layla Company had net assets of $45,000 at the beginning and $80,000 at the the year, shareholders made additional capital investments of $10,000 during th and Layla distributed cash dividends of $2,500 to shareholders during the year. C ing the ending and the beginning net assets and adjusting for additional inves and dividends, the capital maintenance approach would measure Layla's total i as follows: Ending net assets Less: Beginning net assets Net change in assets Less: Additional investment of capital Plus: Capital distributed in dividends Total income for the year $ 80,000 (45,000) $35,000 (10,000) 2,500 27,500 %, S Alen de, "reo e Measurement na Dynamic Economy," Five Monographs on Business Income Economy. Five Monographs See for instance,E.O.Edwards and P. W.Bell, The Theory and Measurement of Business Income (Berkeley Press, 1970 on Business Income (New Yok A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts