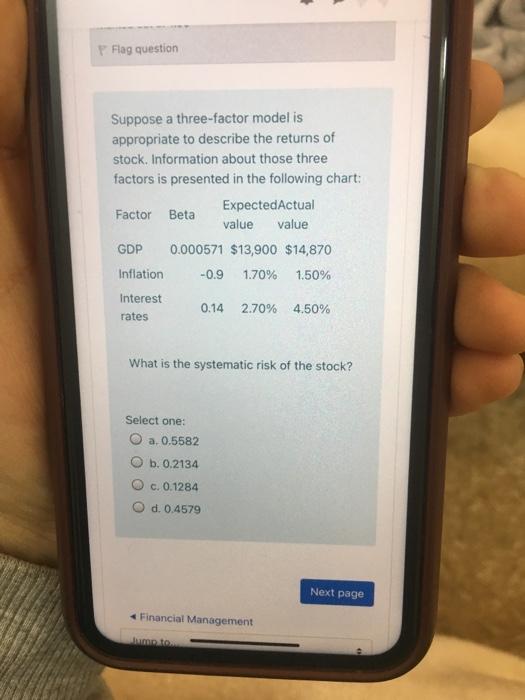

Question: Flag question Suppose a three-factor model is appropriate to describe the returns of stock. Information about those three factors is presented in the following chart:

Flag question Suppose a three-factor model is appropriate to describe the returns of stock. Information about those three factors is presented in the following chart: ExpectedActual Factor Beta value value GDP 0.000571 $13,900 $14,870 Inflation -0.9 1.70% 1.50% Interest 0.14 2.70% 4.50% rates What is the systematic risk of the stock? Select one: O a. 0.5582 b. 0.2134 C. 0.1284 d. 0.4579 Next page Financial Management

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts