Question: Fleury, Inc. is preparing pro-forma financial statements for 2012. A junior analyst has begun the work. You are asked to complete the statements (see the

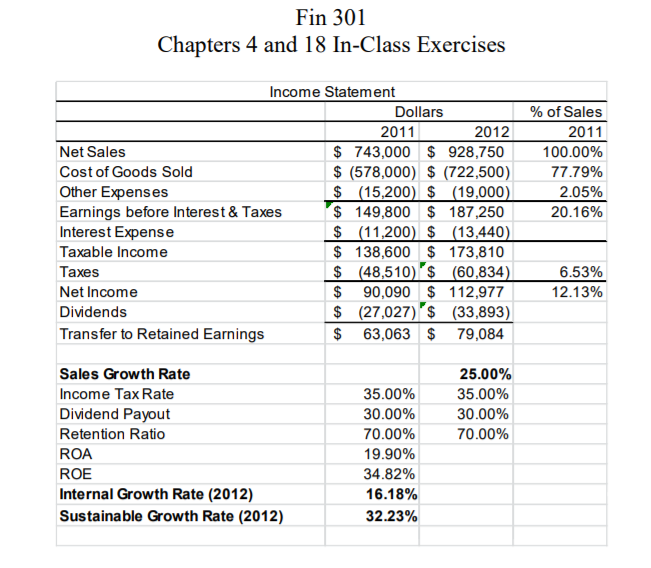

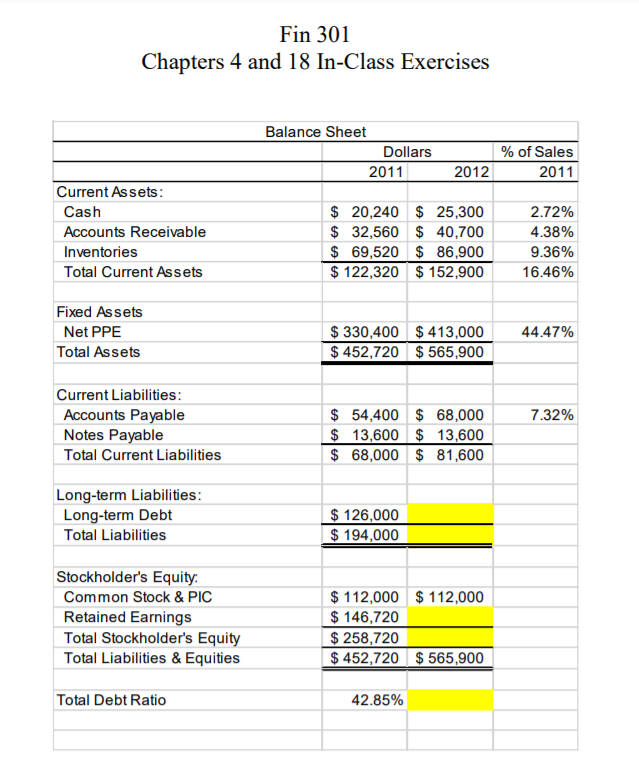

Fleury, Inc. is preparing pro-forma financial statements for 2012. A junior analyst has begun the work. You are asked to complete the statements (see the income statement and balance sheet below). Sales are projected to grow at 25%. All expenses except interest expense is forecasted to remain a constant percent of sales based on 2011 actuals. Interest expense is expected to grow 20% in 2012. Assets are also forecasted to remain as a constant percent of sales based on 2011 actuals.Short-term notes payable and common stock will remain constant. Long-term debt is the plug variable. Complete the balance sheetbelow.What will the Total Debt Ratio be at the end of 2012?

Fin 301 Chapters 4 and 18 In-Class Exercises Income Statement Dollars 2011 2012 Net Sales $ 743,000 $ 928,750 Cost of Goods Sold $ (578,000) $ (722,500) Other Expenses $ (15,200 $ (19,000) Earnings before Interest & Taxes $ 149,800 $ 187,250 Interest Expense $ (11,200) $ (13,440) Taxable income $ 138,600 $ 173,810 Taxes $ (48,510) $ (60,834) Net Income $ 90,090 $ 112,977 Dividends $ (27,027) $ (33,893) Transfer to Retained Earnings $ 63,063 $ 79,084 % of Sales 2011 100.00% 77.79% 2.05% 20.16% 6.53% 12.13% 25.00% 35.00% 30.00% 70.00% Sales Growth Rate Income Tax Rate Dividend Payout Retention Ratio ROA ROE Internal Growth Rate (2012) Sustainable Growth Rate (2012) 35.00% 30.00% 70.00% 19.90% 34.82% 16.18% 32.23% Fin 301 Chapters 4 and 18 In-Class Exercises Balance Sheet Dollars 2011 % of Sales 2011 2012 Current Assets: Cash Accounts Receivable Inventories Total Current Assets $ 20,240 $ 25,300 $ 32,560 $ 40,700 $ 69,520 $ 86,900 $ 122,320 $ 152,900 2.72% 4.38% 9.36% 16.46% Fixed Assets Net PPE Total Assets 44.47% $ 330,400 $ 413,000 $ 452,720 $ 565,900 7.32% Current Liabilities: Accounts Payable Notes Payable Total Current Liabilities $ 54,400 $ 68,000 $ 13,600 $ 13,600 $ 68,000 $ 81,600 Long-term Liabilities: Long-term Debt Total Liabilities $ 126,000 $ 194,000 Stockholder's Equity: Common Stock & PIC Retained Earnings Total Stockholder's Equity Total Liabilities & Equities $ 112,000 $ 112,000 $ 146,720 $ 258,720 $ 452,720 $ 565,900 Total Debt Ratio 42.85%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts