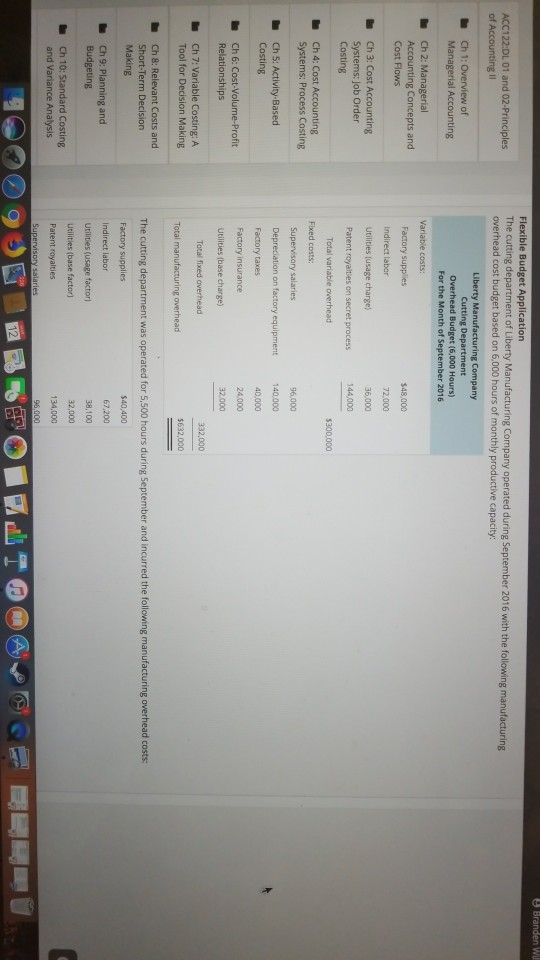

Question: Flexible Budget Application The cutting de overhead cost budget based on 6,000 hours of monthly productive capacity ACC122:DL. 01 and 02-Principles ty Manufacturing Company operated

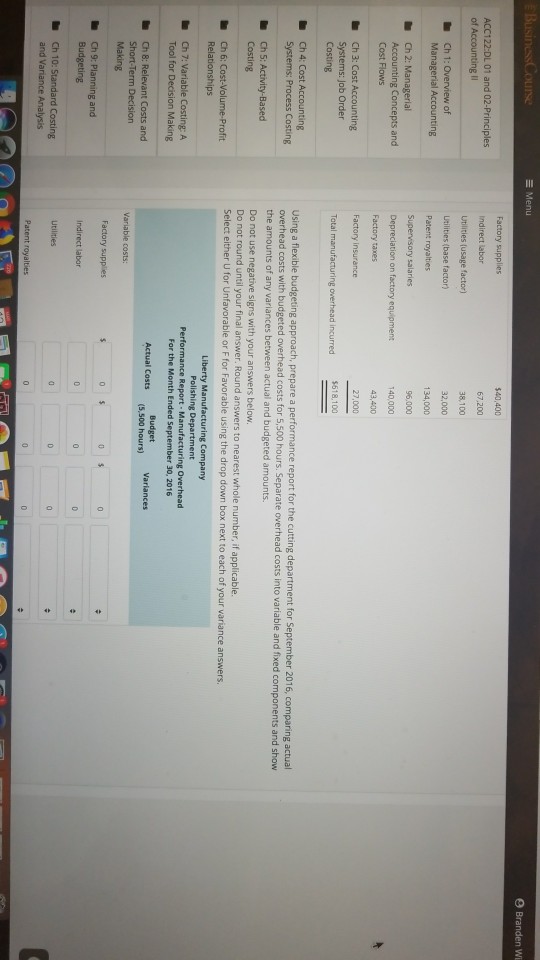

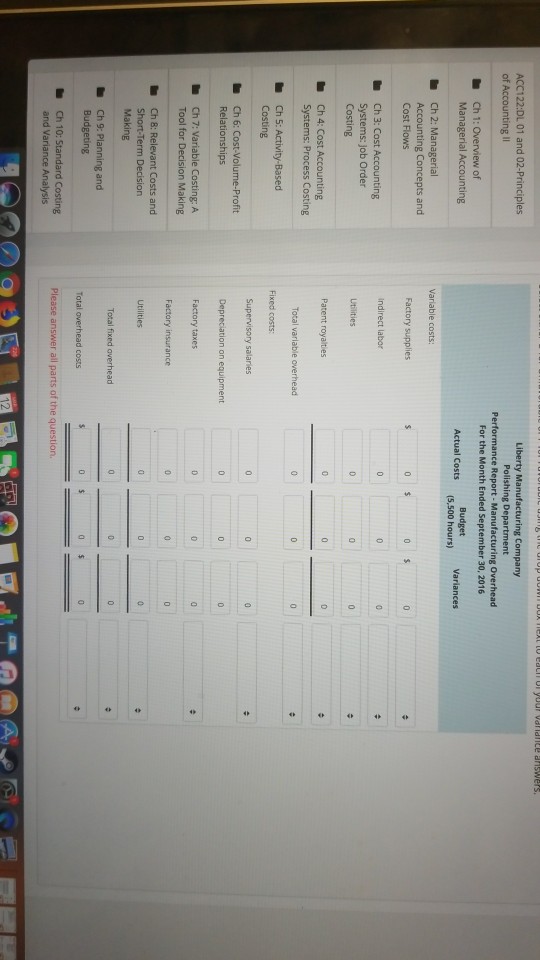

Flexible Budget Application The cutting de overhead cost budget based on 6,000 hours of monthly productive capacity ACC122:DL. 01 and 02-Principles ty Manufacturing Company operated during September 2016 with the following manufacturing Ch 1: Overview of Managerial Accounting Overhead Budget (6,000 Hours) Ch 2: Managerial Accounting Concepts and Cost Flows Indirect labor Ch 3: Cost Accounting Systems: Job Order Patent royalties on secret process Total variable overhead $300,000 Ch 4: Cost Accounting Systems: Process Costing Supervisory salaries Depreciation on factory equipment Factory taxes Factory insurance Utilities (base charge) Ch15: Activity-Based 140,000 Relationships 832,000 C17: Variable Costing: A Tool for Decision Making $632,000 Ch 8: Relevant Costs and Short-Term Decision Making The cutting department was operated for 5,500 hours during September and incurred the following manufacturing overhead costs Factory supplies Ch 9: Planning and Budgeting utilities (base factor) Ch 10: Standard Costing and Variance Analysis 134,000 Patent royalties

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts