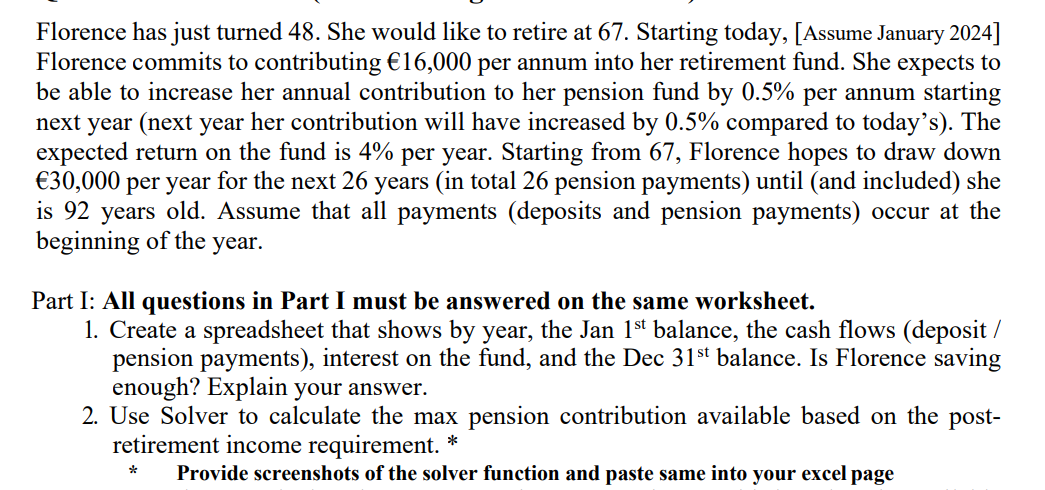

Question: Florence has just turned 4 8 . She would like to retire at 6 7 . Starting today, [ Assume January 2 0 2 4

Florence has just turned She would like to retire at Starting today, Assume January

Florence commits to contributing per annum into her retirement fund. She expects to

be able to increase her annual contribution to her pension fund by per annum starting

next year next year her contribution will have increased by compared to today's The

expected return on the fund is per year. Starting from Florence hopes to draw down

per year for the next years in total pension payments until and included she

is years old. Assume that all payments deposits and pension payments occur at the

beginning of the year.

Part I: All questions in Part I must be answered on the same worksheet.

Create a spreadsheet that shows by year, the Jan balance, the cash flows deposit

pension payments interest on the fund, and the Dec balance. Is Florence saving

enough? Explain your answer.

Use Solver to calculate the max pension contribution available based on the post

retirement income requirement.

Provide screenshots of the solver function and paste same into your excel page

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock