Question: Flounder Company is a U . S . - based company that designs and builds compressors for large HVAC units. Flounder decides to build a

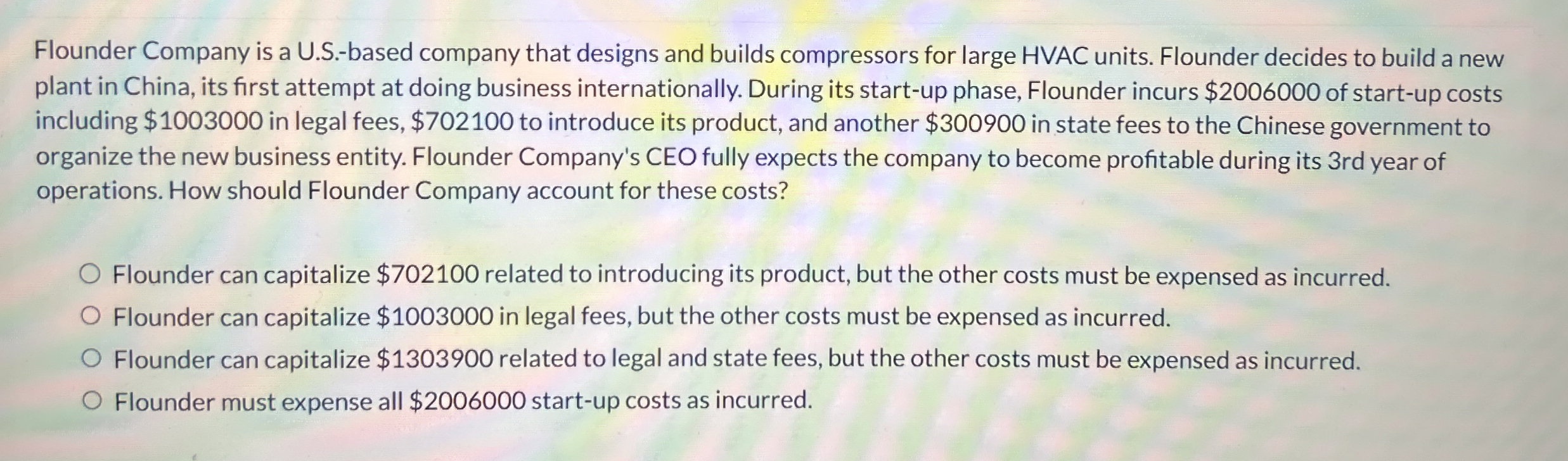

Flounder Company is a USbased company that designs and builds compressors for large HVAC units. Flounder decides to build a new plant in China, its first attempt at doing business internationally. During its startup phase, Flounder incurs $ of startup costs including $ in legal fees, $ to introduce its product, and another $ in state fees to the Chinese government to organize the new business entity. Flounder Company's CEO fully expects the company to become profitable during its rd year of operations. How should Flounder Company account for these costs?

Flounder can capitalize $ related to introducing its product, but the other costs must be expensed as incurred.

Flounder can capitalize $ in legal fees, but the other costs must be expensed as incurred.

Flounder can capitalize $ related to legal and state fees, but the other costs must be expensed as incurred.

Flounder must expense all $ startup costs as incurred.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock