Question: FLP is having trouble deciding between two different machines to use on the bottling line. One is adequate to meet their current production goals, but

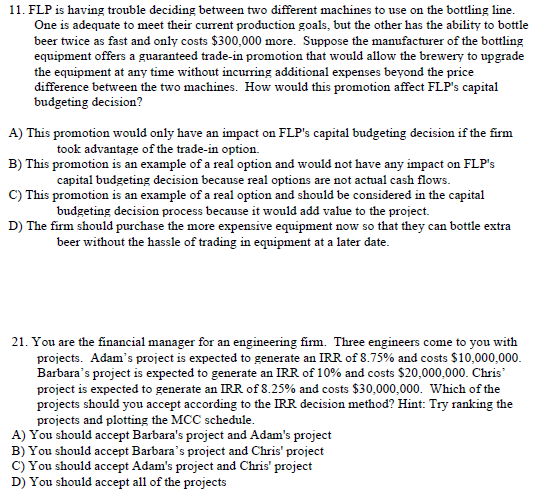

FLP is having trouble deciding between two different machines to use on the bottling line. One is adequate to meet their current production goals, but the other has the ability to bottle beer twice as fast and only costs dollar 300,000 more. Suppose the manufacturer of the bottling equipment offers a guaranteed trade-in promotion that would allow the brewery to upgrade the equipment at any time without incurring additional expenses beyond the price difference between the two machines. How would this promotion affect FLP's capital budgeting decision? This promotion would only have an impact on FLP's capital budgeting decision if the firm took advantage of the trade-in option. This promotion is an example of a real option and would not have any impact on FLP's capital budgeting decision because real options are not actual cash flows. This promotion is an example of a real option and should be considered in the capital budgeting decision process because it would add value to the project. The firm should purchase the more expensive equipment now so that they can bottle extra beer without the hassle of trading in equipment at a later date. You are the financial manager for an engineering firm. Three engineers come to you with projects. Adam's project is expected to generate an IRR of 8.75 percentage and costs dollar 10,000,000. Barbara's project is expected to generate an IRR of 10 percentage and costs dollar 20,000,000. Chris' project is expected to generate an IRR of 8.25 percentage and costs dollar 30,000,000. Which of the projects should you accept according to the IRR decision method? You should accept Barbara's project and Adam's project You should accept Barbara's project and Chris' project You should accept Adam's project and Chris' project You should accept all of the projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts