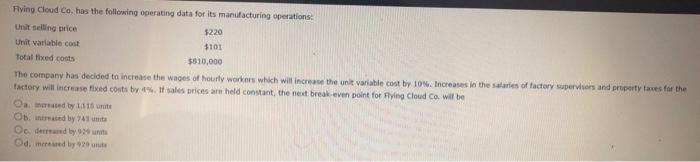

Question: Flying Cloud Co. has the following operating data for its manufacturing operations Unit selling price 5220 Unit variable cost $101 Total fixed costs $310,000 The

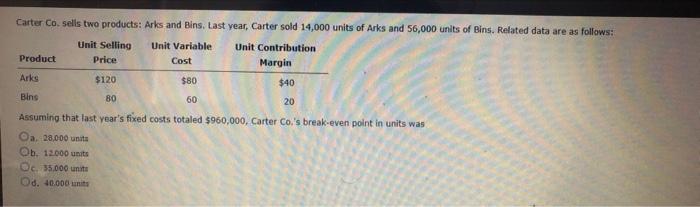

Flying Cloud Co. has the following operating data for its manufacturing operations Unit selling price 5220 Unit variable cost $101 Total fixed costs $310,000 The company has decided to increase the wages of hourly workers which will increase the unit variable cost by 10. Increases in the salaries of factory supervisors and property taxes for the Factory will increase fixed costs by If sales trices are held constant, the next break even point for Flying Cloud Co will be Oamera ty turut Obered by 741 O demandy d. mered by 20 Carter Co. sells two products: Arks and Bins. Last year, Carter sold 14,000 units of Arks and 56,000 units of Bins. Related data are as follows: Unit Selling Price Unit Variable Cost Product Unit Contribution Margin $40 Arks $120 $80 Bins 80 60 20 Assuming that last year's fixed costs totaled $960,000. Carter Co.'s break-even point in units was Oa. 28.000 units Ob. 12.000 units c. 35.000 units Od. 40.000 units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts