Question: FMI Class Exercise One 5) Suppose that you purchase a 91-day Treasury bill for $9,850 that is worth $10,000 when it matures. The security's annualized

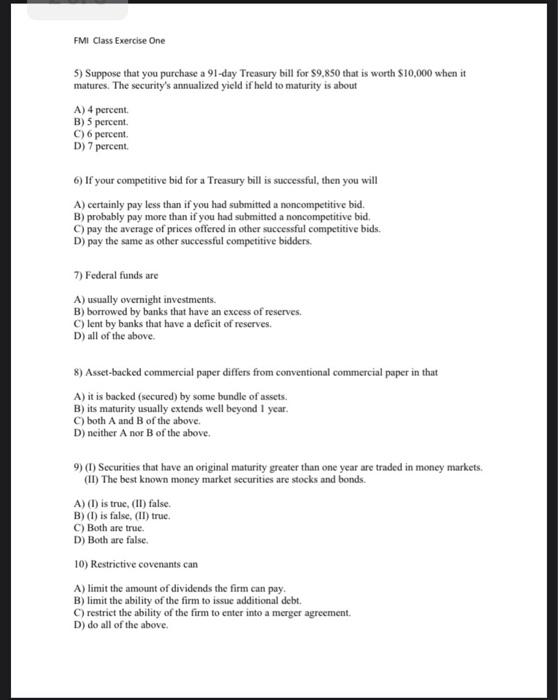

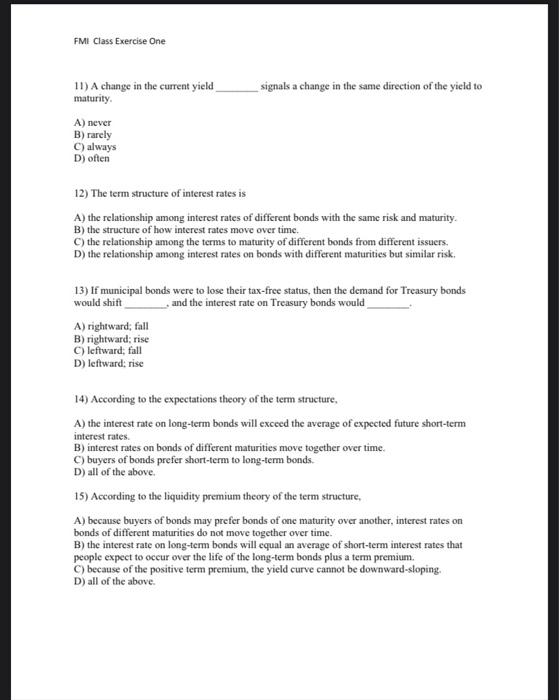

FMI Class Exercise One 5) Suppose that you purchase a 91-day Treasury bill for $9,850 that is worth $10,000 when it matures. The security's annualized yield if held to maturity is about A) 4 percent B) 5 percent C) 6 percent D) 7 percent 6) If your competitive bid for a Treasury bill is successful, then you will A) certainly pay less than if you had submitted a noncompetitive bid. B) probably pay more than if you had submitted a noncompetitive bid, C) pay the average of prices offered in other successful competitive bids. D) pay the same as other successful competitive bidders. 7) Federal funds are A) usually overnight investments. B) borrowed by banks that have an excess of reserves. C) lent by banks that have a deficit of reserves. D) all of the above 8) Asset-backed commercial paper differs from conventional commercial paper in that A) it is backed (secured) by some bundle of assets. B) its maturity usually extends well beyond 1 year C) both A and B of the above. D) neither A nor B of the above. 9) (1) Securities that have an original maturity greater than one year are traded in money markets. (11) The best known money market securities are stocks and bonds. A) () is true, (II) false B) (I) is false, (II) truc C) Both are true D) Both are false 10) Restrictive covenants can A) limit the amount of dividends the firm can pay. B) limit the ability of the firm to issue additional debt. C) restrict the ability of the firm to enter into a merger agreement D) do all of the above FMI Class Exercise One signals a change in the same direction of the yield to 11) A change in the current yield maturity A) never B) rarely C) always D) often 12) The term structure of interest rates is A) the relationship among interest rates of different bonds with the same risk and maturity. B) the structure of how interest rates move over time. C) the relationship among the terms to maturity of different bonds from different issuers, D) the relationship among interest rates on bonds with different maturities but similar risk 13) If municipal bonds were to lose their tax-free status, then the demand for Treasury bonds would shift _.and the interest rate on Treasury bonds would A) rightward, fall B) rightward; rise C) leftward, fall D) leftward, rise 14) According to the expectations theory of the term structure, A) the interest rate on long-term bonds will exceed the average of expected future short-term interest rates B) interest rates on bonds of different maturities move together over time. C) buyers of bonds prefer short-term to long-term bonds. D) all of the above 15) According to the liquidity premium theory of the term structure, A) because buyers of bonds may prefer bonds of one maturity over another, interest rates on bonds of different maturities do not move together over time. B) the interest rate on long-term bonds will equal an average of short-term interest rates that people expect to occur over the life of the long-term bonds plus a term premium. C) because of the positive term premium, the yield curve cannot be downward-sloping D) all of the above. FMI Class Exercise One signals a change in the same direction of the yield to 11) A change in the current yield maturity A) never B) rarely C) always D) often 12) The term structure of interest rates is A) the relationship among interest rates of different bonds with the same risk and maturity. B) the structure of how interest rates move over time. C) the relationship among the terms to maturity of different bonds from different issuers, D) the relationship among interest rates on bonds with different maturities but similar risk 13) If municipal bonds were to lose their tax-free status, then the demand for Treasury bonds would shift _.and the interest rate on Treasury bonds would A) rightward, fall B) rightward; rise C) leftward, fall D) leftward, rise 14) According to the expectations theory of the term structure, A) the interest rate on long-term bonds will exceed the average of expected future short-term interest rates B) interest rates on bonds of different maturities move together over time. C) buyers of bonds prefer short-term to long-term bonds. D) all of the above 15) According to the liquidity premium theory of the term structure, A) because buyers of bonds may prefer bonds of one maturity over another, interest rates on bonds of different maturities do not move together over time. B) the interest rate on long-term bonds will equal an average of short-term interest rates that people expect to occur over the life of the long-term bonds plus a term premium. C) because of the positive term premium, the yield curve cannot be downward-sloping D) all of the above. FMI Class Exercise One 5) Suppose that you purchase a 91-day Treasury bill for $9,850 that is worth $10,000 when it matures. The security's annualized yield if held to maturity is about A) 4 percent B) 5 percent C) 6 percent D) 7 percent 6) If your competitive bid for a Treasury bill is successful, then you will A) certainly pay less than if you had submitted a noncompetitive bid. B) probably pay more than if you had submitted a noncompetitive bid, C) pay the average of prices offered in other successful competitive bids. D) pay the same as other successful competitive bidders. 7) Federal funds are A) usually overnight investments. B) borrowed by banks that have an excess of reserves. C) lent by banks that have a deficit of reserves. D) all of the above 8) Asset-backed commercial paper differs from conventional commercial paper in that A) it is backed (secured) by some bundle of assets. B) its maturity usually extends well beyond 1 year C) both A and B of the above. D) neither A nor B of the above. 9) (1) Securities that have an original maturity greater than one year are traded in money markets. (11) The best known money market securities are stocks and bonds. A) () is true, (II) false B) (I) is false, (II) truc C) Both are true D) Both are false 10) Restrictive covenants can A) limit the amount of dividends the firm can pay. B) limit the ability of the firm to issue additional debt. C) restrict the ability of the firm to enter into a merger agreement D) do all of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts