Question: FNCE 4 D2L Grades Mic X Course Cross H M Inbox ( G book v S TForce Valuation filled A filled A y! mru we

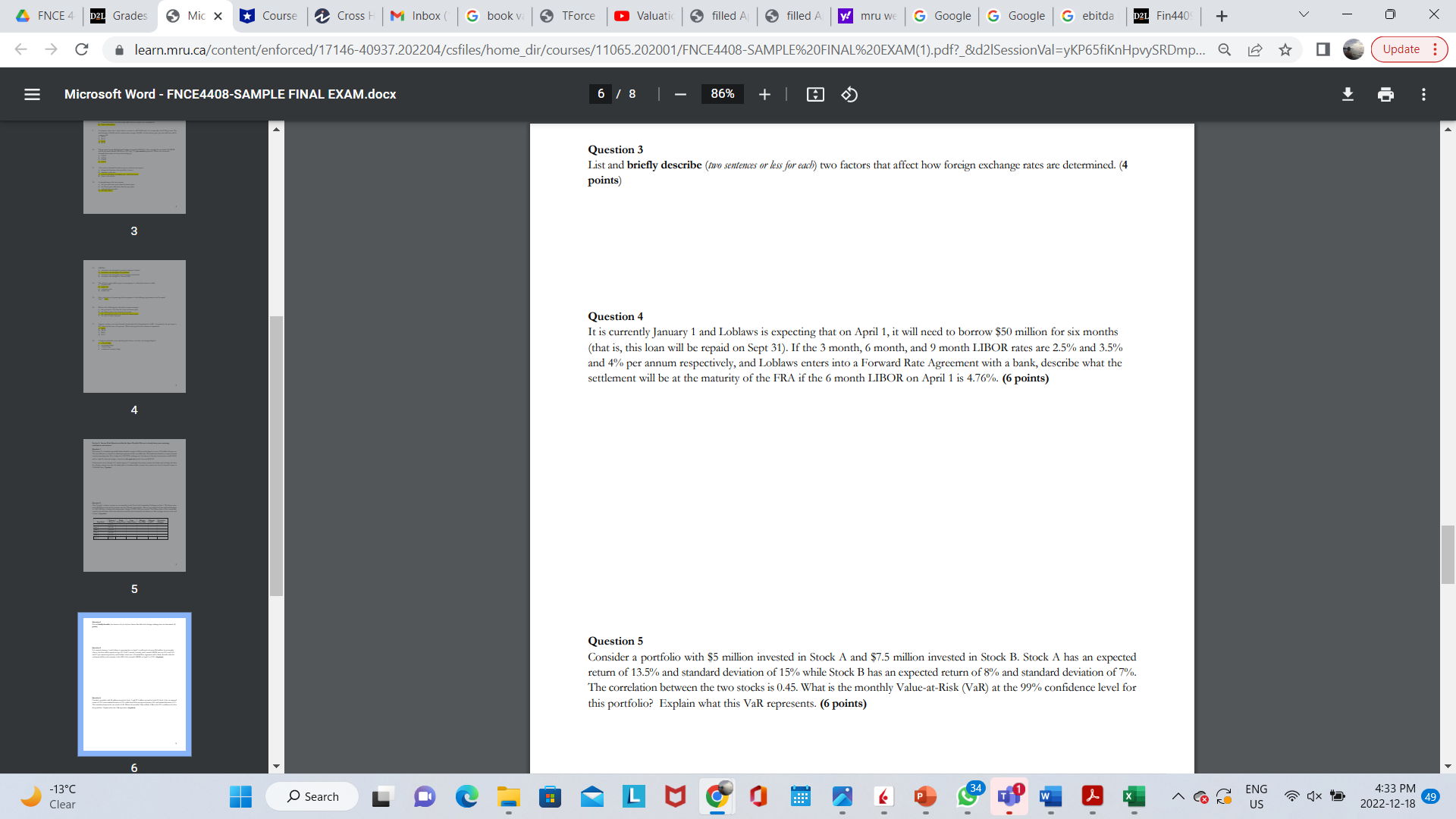

FNCE 4 D2L Grades Mic X Course Cross H M Inbox ( G book v S TForce Valuation filled A filled A y! mru we G Google G Google G ebitda D2L Fin440 + V X > C a learn.mru.ca/content/enforced/17146-40937.202204/csfiles/home_dir/courses/11065.202001/FNCE4408-SAMPLE%20FINAL%20EXAM(1).pdf?_&d21SessionVal=yKP65fiknHpvySRDmp... @ Update E Microsoft Word - FNCE4408-SAMPLE FINAL EXAM.docx 6 / 8 86% + Question 3 List and briefly describe (two sentences or less for each) two factors that affect how foreign exchange rates are determined. (4 points) 3 Question 4 It is currently January 1 and Loblaws is expecting that on April 1, it will need to borrow $50 million for six months (that is, this loan will be repaid on Sept 31). If the 3 month, 6 month, and 9 month LIBOR rates are 2.5% and 3.5% and 4% per annum respectively, and Loblaws enters into a Forward Rate Agreement with a bank, describe what the settlement will be at the maturity of the FRA if the 6 month LIBOR on April 1 is 4.76%. (6 points) 4 15 Question 5 Consider a portfolio with $5 million invested in Stock A and $7.5 million invested in Stock B. Stock A has an expected return of 13.5% and standard deviation of 15% while Stock B has an expected return of 8% and standard deviation of 7%. The correlation between the two stocks is 0.45. What is the monthly Value-at-Risk (VaR) at the 99% confidence level for this portfolio? Explain what this VaR represents. (6 points) 6 - 13 . C Search - B - Lugg w ENG 4:33 PM Clear P X US 2022-12-18 49

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts