Question: Follow the instructions. Please, explain your solutions step by step in detail. Company purchased a new machine for $400,000 on September 1, 2020. It is

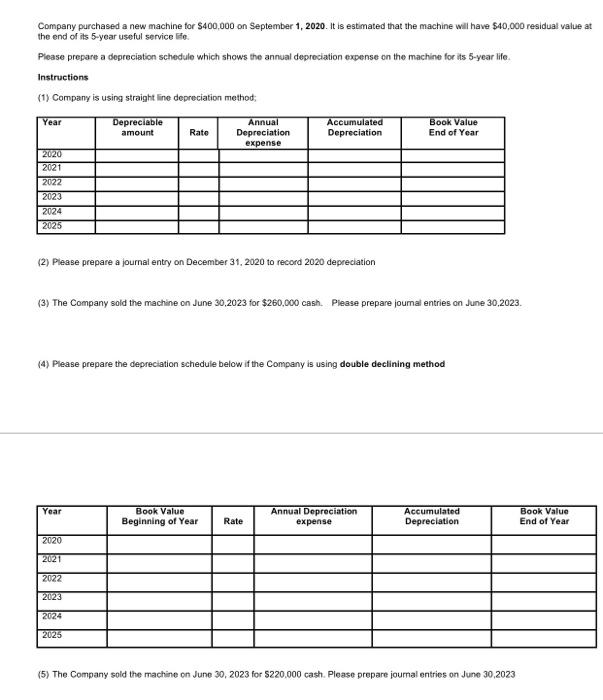

Company purchased a new machine for $400,000 on September 1, 2020. It is estimated that the machine will have $40,000 residual value at the end of its 5-year useful service life. Please prepare a depreciation schedule which shows the annual depreciation expense on the machine for its 5-year life Instructions (1) Company is using straight line depreciation method: Year Depreciable amount Annual Depreciation expense Accumulated Depreciation Rate Book Value End of Year 2020 2021 2022 2023 2024 2025 (2) Please prepare a journal entry on December 31, 2020 to record 2020 depreciation (3) The Company sold the machine on June 30,2023 for $260.000 cash. Please prepare joumal entries on June 30,2023. (4) Please prepare the depreciation schedule below if the Company is using double declining method Year Book Value Beginning of Year Rate Annual Depreciation expense Accumulated Depreciation Book Value End of Year 2020 2021 2022 2023 2024 2025 (5) The Company sold the machine on June 30, 2023 for $220.000 cash. Please prepare journal entries on June 30,2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts