Question: Following 2019 and interpret each ( use it in a sentence.) Current Ratio The ratio is__ Interpretation:________ Quick Ratio The ratio is__ Interpretation:_______ Inventory turnover

Following 2019 and interpret each ( use it in a sentence.)

Following 2019 and interpret each ( use it in a sentence.)

Current Ratio The ratio is__ Interpretation:________

Quick Ratio The ratio is__ Interpretation:_______

Inventory turnover The ratio is__ Interpretation:_______

Return on Assets The ratio is__ Interpretation:_______

Asset Turnover The ratio is___ Interpretation:_______

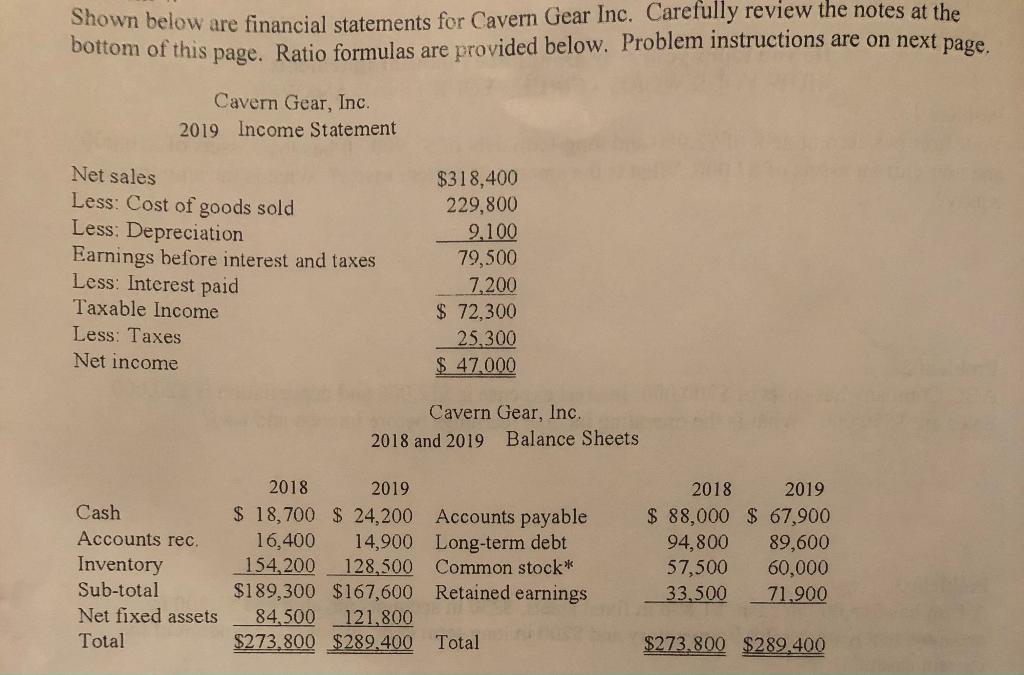

Shown below are financial statements for Cavern Gear Inc. Carefully review the notes at the bottom of this page. Ratio formulas are provided below. Problem instructions are on next page. Cavern Gear, Inc. 2019 Income Statement Net sales Less: Cost of goods sold Less: Depreciation Earnings before interest and taxes Less: Interest paid Taxable Income Less: Taxes Net income $318,400 229,800 9,100 79,500 7,200 $ 72,300 25.300 $ 47,000 Cavern Gear, Inc. 2018 and 2019 Balance Sheets Cash Accounts rec. Inventory Sub-total Net fixed assets Total 2018 2019 $ 18,700 $ 24,200 Accounts payable 16,400 14,900 Long-term debt 154,200 128,500 Common stock* $189,300 $167,600 Retained earnings 84,500 121,800 $273,800 $289.400 Total 2018 2019 $ 88,000 $ 67,900 94,800 89,600 57,500 60,000 33,500 71.900 $273.800 $289,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts