Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following a review, a number of Inventory related adjustments are required. The company uses a perpetual inventory system. A count of inventory on hand

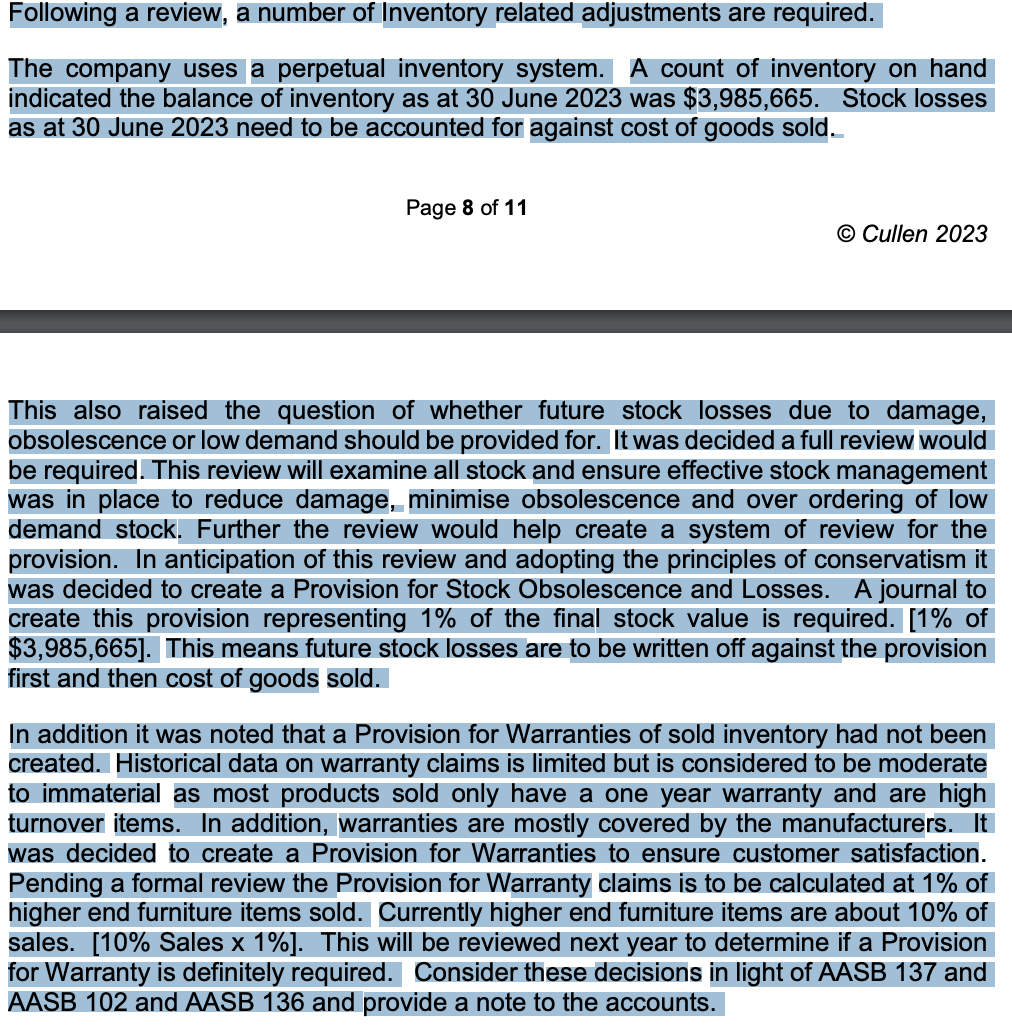

Following a review, a number of Inventory related adjustments are required. The company uses a perpetual inventory system. A count of inventory on hand indicated the balance of inventory as at 30 June 2023 was $3,985,665. Stock losses as at 30 June 2023 need to be accounted for against cost of goods sold. Page 8 of 11 Cullen 2023 This also raised the question of whether future stock losses due to damage, obsolescence or low demand should be provided for. It was decided a full review would be required. This review will examine all stock and ensure effective stock management was in place to reduce damage, minimise obsolescence and over ordering of low demand stock. Further the review would help create a system of review for the provision. In anticipation of this review and adopting the principles of conservatism it was decided to create a Provision for Stock Obsolescence and Losses. A journal to create this provision representing 1% of the final stock value is required. [1% of $3,985,665]. This means future stock losses are to be written off against the provision first and then cost of goods sold. In addition it was noted that a Provision for Warranties of sold inventory had not been created. Historical data on warranty claims is limited but is considered to be moderate to immaterial as most products sold only have a one year warranty and are high turnover items. In addition, warranties are mostly covered by the manufacturers. It was decided to create a Provision for Warranties to ensure customer satisfaction. Pending a formal review the Provision for Warranty claims is to be calculated at 1% of higher end furniture items sold. Currently higher end furniture items are about 10% of sales. [10% Sales x 1%]. This will be reviewed next year to determine if a Provision for Warranty is definitely required. Consider these decisions in light of AASB 137 and AASB 102 and AASB 136 and provide a note to the accounts.

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The image provided appears to be an excerpt from a company document discussing their inventory accou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started