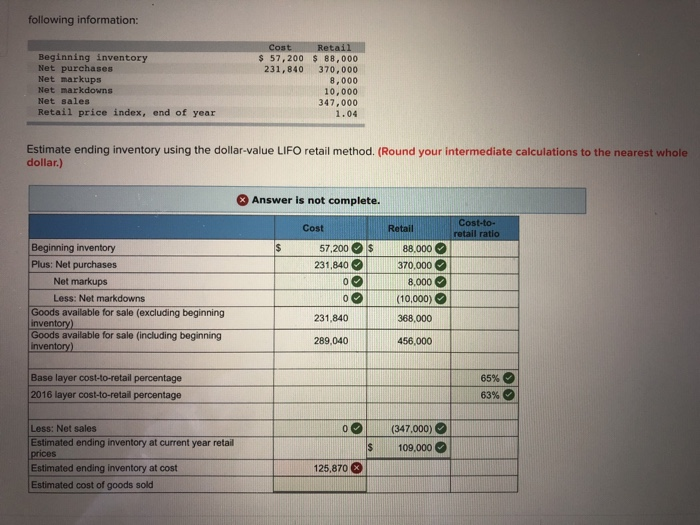

Question: following information: Cost Beginning inventory Net purchases Net markups Net markdowns Net sales Retail price index, end of year 57,200 88,000 231,840 370,000 8,000 10,000

following information: Cost Beginning inventory Net purchases Net markups Net markdowns Net sales Retail price index, end of year 57,200 88,000 231,840 370,000 8,000 10,000 347,000 1.04 Estimate ending inventory using the dollar-value LIFO retail method. (Round your intermediate calculations to the nearest whole dollar.) Answer is not complete. Cost-to- Cost Retail Beginning inventory Plus: Net purchases 57,200 s 88.000 231,840370.000 8.000 Net markups (10,000) 368,000 456,000 Less: Net markdowns Goods available for sale (excluding beginning inventory) Goods available for sale (including beginning inventory) 231,840 289,040 Base layer cost-to-retail percentage 2016 layer cost-to-retail percentage 65% 63% (347.000) Less: Net sales Estimated ending inventory at current year retail Estimated ending inventory at cost Estimated cost of goods sold $109,000 125,870

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts