Question: The following selected accounts and their current balances appear in the ledger of Case-It Co. for the fiscal year ended November 30, 2010: 1. Prepare

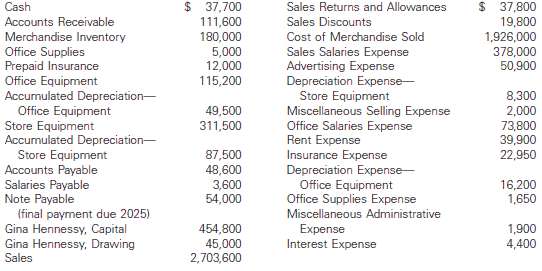

The following selected accounts and their current balances appear in the ledger of Case-It Co. for the fiscal year ended November 30, 2010:

1. Prepare a multiple-step income statement.2. Prepare a statement of owner's equity.3. Prepare a report form of balance sheet, assuming that the current portion of the note payable is $8,000.4. Briefly explain(a) How multiple-step and single-step income statements differ and(b) How report-form and account-form balance sheetsdiffer.

$ 37,700 Cash Sales Returns and Allowances 37,800 19,800 1,926,000 378,000 50,900 %24 Accounts Receivable 111,600 180,000 5,000 12,000 Sales Discounts Merchandise Inventory Office Supplies Prepaid Insurance Office Equipment Accumulated Depreciation- Office Equipment Store Equipment Accumulated Depreciation- Store Equipment Accounts Payable Salaries Payable Note Payable (final payment due 2025) Gina Hennessy, Capital Gina Hennessy, Drawing Sales Cost of Merchandise Sold Sales Salaries Expense Advertising Expense Depreciation Expense- Store Equipment Miscellaneous Selling Expense Office Salaries Expense Rent Expense Insurance Expense Depreciation Expense- Office Equipment Office Supplies Expense 115,200 8,300 49,500 311,500 2,000 73,800 39,900 22,950 87,500 48,600 3,600 54,000 16,200 1,650 Miscellaneous Administrative 1,900 4,400 454,800 45,000 2,703,600 Expense Interest Expense

Step by Step Solution

3.36 Rating (174 Votes )

There are 3 Steps involved in it

1 2 3 4 a Multistep income statements allow employees to ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

46-B-A-M-B (61).docx

120 KBs Word File