Question: following two proiects nurilabie. table [ [ Fatr , Cawh Plew [ a ] , ] , [ 8 , - 1 4 n

following two proiects nurilabie.

tableFatrCawh Plew anetit,nt caa

'What it The parysock petiod for each propect?

th Which if eatere ef the propects should the compary nooper?

tableA Hayelit,pemerfiremePemer Anpat aisaptares,

following twe propects Reblatie.

a What is the pepbaca period for ewoh propect?

tableA Treserin,Ftershymisfeas

A tion evaluates all of is projects by appling the ikR nile.

tableTintT

a What is the penjectrs iba?

table

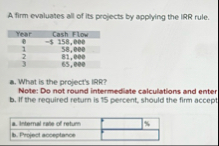

A firm evaluates all of its projects by applying the IRR rule.

tableYear Cash nlou, ebe ebe ebe ebe

a What is the project's IPR?

Note: Do not round intermediate calculations and enter your answetr as a percent rounded b If the regulred return is ts percent, should the ferm accept the projecl?

tablea Intemal rate of retum,b Propect acceptarice,

A firm evaluates all of its projects by applying the IRR rule.

tableYearCash FliseSBS eee

a What is the projects IRR?

Note: Do not round intermediate calculations and enter your answer b Whe reguired return is percent, should the firm accept the project?

tablea Internal rate of retum,

A firm evaluates all of its projects by applying the IRR rule.

tableWetrCash FTow$ eee eees eee

a What is the project's IRR?

Note: Do not round intermediate calculations and enter

b If the reguired return is percent, should the firm accept

tableA Intemal rale of retum,$b Proped acoeptarec,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock