Question: Font Clipboard Alignment E27 B C D E F G H 5 PROBLEM 1 6 Seattle Health Plans currently uses zero debt financing. Its operating

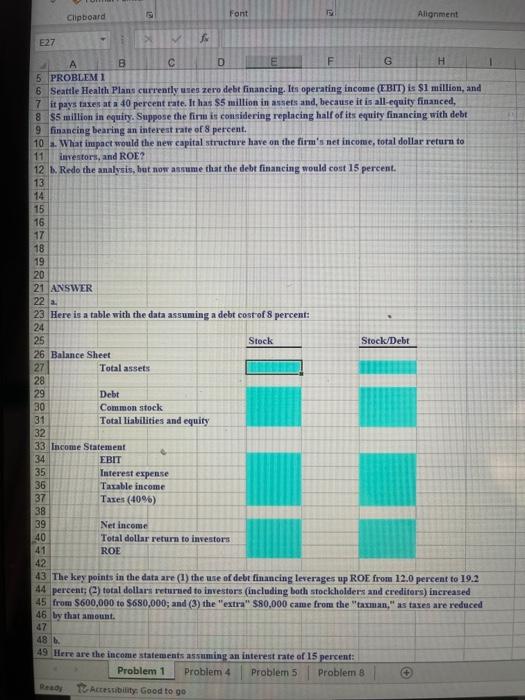

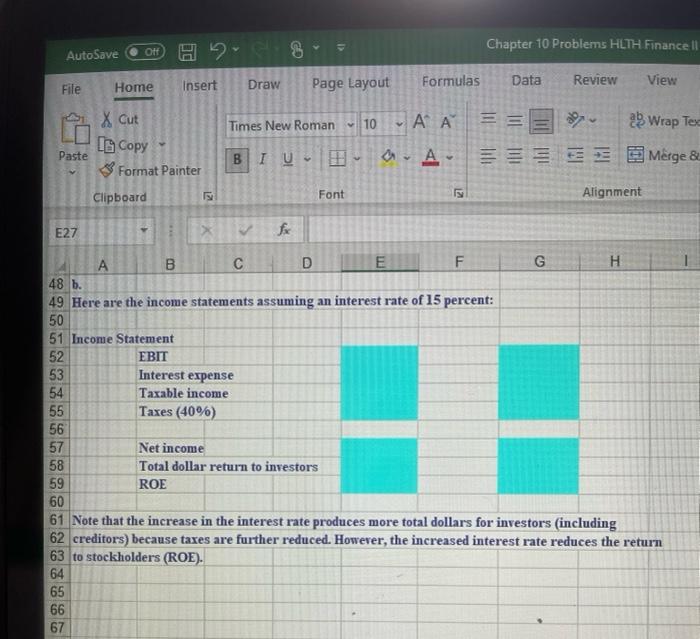

Font Clipboard Alignment E27 B C D E F G H 5 PROBLEM 1 6 Seattle Health Plans currently uses zero debt financing. Its operating income (EBIT) is $1 million, and 7 it pays taken at a 40 percent rate. It has $5 million in assets and, because it is all-equity financed, 8 $5 million in equity. Suppose the firm is considering replacing half of its equity financing with debt 9 financing bearing an interest rate of 8 percent. 10 . What impact would the new capital structure have on the firm's net income, total dollar return to 11 investors, and ROE? 12 6. Redo the analysis, but now assume that the debt financing would cost 15 percent. 13 14 15 16 17 18 19 20 21 ANSWER 22 a 23 Here is a table with the data assuming a debt cost of 8 percent: 24 25 Stock Stock/Debt 26 Balance Sheet 27 Total assets 28 29 Debt 30 Common stock 31 Total liabilities and equity 32 33 Income Statement 34 EBIT 35 Interest expense 36 Taxable income 37 Taxes (40%) 38 39 Net income 40 Total dollar return to investors 41 ROE 42 43. The key points in the data are (1) the use of debt financing leverages up ROE from 12.0 percent to 19.2 44 percent: (C) total dollars returned to investors (including both stockholders and creditors) increased 45 from $600,000 to $680,000; and (3) the "extra" $80,000 came from the "taxman," as taxes are reduced 46 by that amount. 47 48 49 Here are the income statements assuming an interest rate of 15 percent: Problem 1 Problem 4 Problem 5 Problem 8 Thesability: Good to go Chapter 10 Problems HLTH Finance || >> AutoSave On H - B Home Insert Draw File Formulas Page Layout Data Review View Times New Roman 10 ' ' X Cut LG Copy Paste Format Painter 2 Wrap Tea E Mrge & BIU a A Clipboard 12 Font is Alignment E27 E B A C D E F G H 48 b. 49 Here are the income statements assuming an interest rate of 15 percent: 50 51 Income Statement 52 EBIT 53 Interest expense 54 Taxable income 55 Taxes (40%) 56 57 Net income 58 Total dollar return to investors 59 ROE 60 61 Note that the increase in the interest rate produces more total dollars for investors (including 62 creditors) because taxes are further reduced. However, the increased interest rate reduces the return 63 to stockholders (ROE). 64 65 66 67

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts