Question: Font Paragraph Styles Bonds- practice problems A bond has a coupon rate of 7% and has 5 years until maturity. If the current yield to

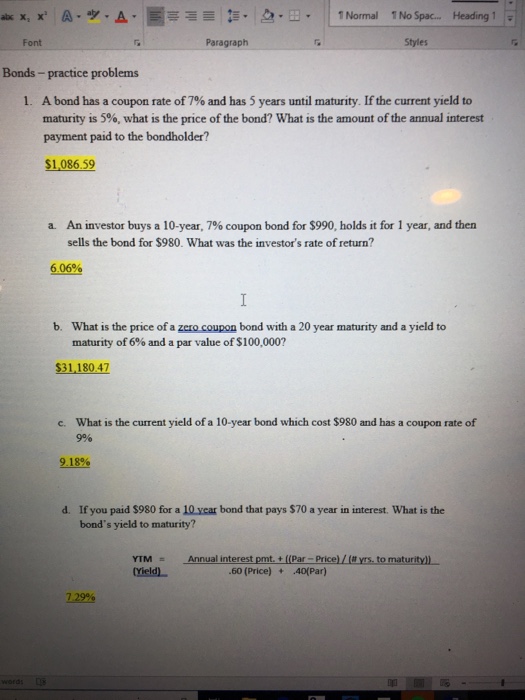

Font Paragraph Styles Bonds- practice problems A bond has a coupon rate of 7% and has 5 years until maturity. If the current yield to maturity is 596, what is the price of the bond? what is the amount of the annual interest payment paid to the bondholder? 1. $1,086.59 An investor buys a 10-year, 7% coupon bond for $990, holds it for 1 year, and then sells the bond for $980. What was the investor's rate of return? a 6,06% b. What is the price of a zero coupon bond with a 20 year maturity and a yield to maturity of 6% and a par value of$100,000? $31,180 47 What is the current yield of a 10-year bond which cost $980 and has a coupon rate of 9% c. 918% d. If you paid $980 for a 10 ycar bond that pays $70 a year in interest. What is the bond's yield to maturity? Annual interest prnt. + ((Par-Price)/(#yrs.tomaturity)L VIN = Yield) .60 (Price) + 40(Par)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts