Question: . Fool Proof Software is considering an expansion project having life for four years. The proposed project has the following features: Initial cost of the

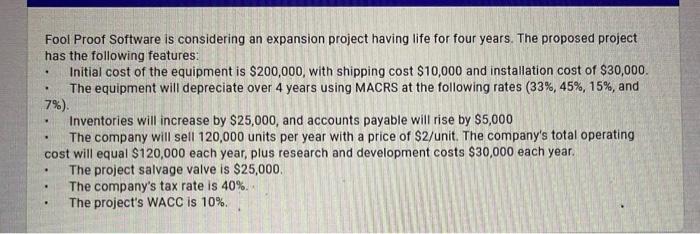

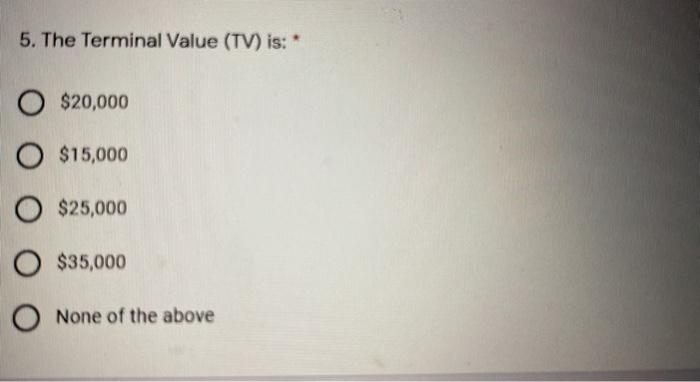

. Fool Proof Software is considering an expansion project having life for four years. The proposed project has the following features: Initial cost of the equipment is $200,000, with shipping cost $10,000 and installation cost of $30,000. The equipment will depreciate over 4 years using MACRS at the following rates (33%, 45%, 15%, and 7%) Inventories will increase by $25,000, and accounts payable will rise by $5,000 The company will sell 120,000 units per year with a price of $2/unit. The company's total operating cost will equal $120,000 each year, plus research and development costs $30,000 each year. The project salvage valve is $25,000 The company's tax rate is 40%. The project's WACC is 10%. . 5. The Terminal Value (TV) is: * $20,000 O $15,000 $25,000 $35,000 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts