Question: Fool Proof Software is considering an expansion project having life for four years. The proposed project has the following features: Initial cost of the equipment

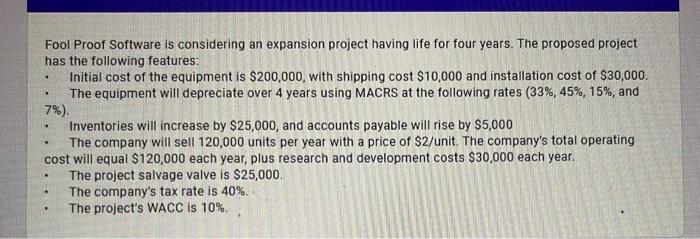

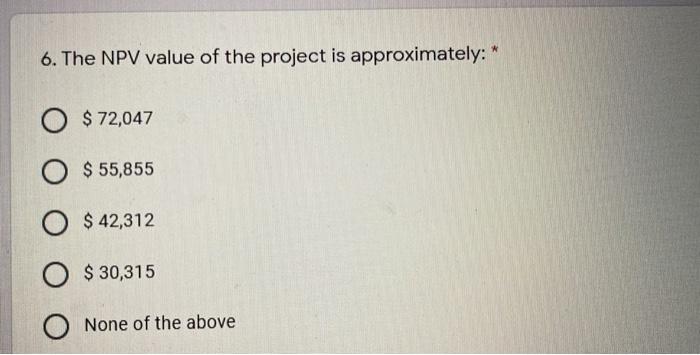

Fool Proof Software is considering an expansion project having life for four years. The proposed project has the following features: Initial cost of the equipment is $200,000, with shipping cost $10,000 and installation cost of $30,000. The equipment will depreciate over 4 years using MACRS at the following rates (33%, 45%, 15%, and 7%). Inventories will increase by $25,000, and accounts payable will rise by $5,000 The company will sell 120,000 units per year with a price of $2/unit. The company's total operating cost will equal $120,000 each year, plus research and development costs $30,000 each year. The project salvage valve is $25,000 The company's tax rate is 40%. The project's WACC is 10% geen gears using mag * 6. The NPV value of the project is approximately: O $ 72,047 O $ 55,855 O $ 42,312 $ O $ 30,315 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts