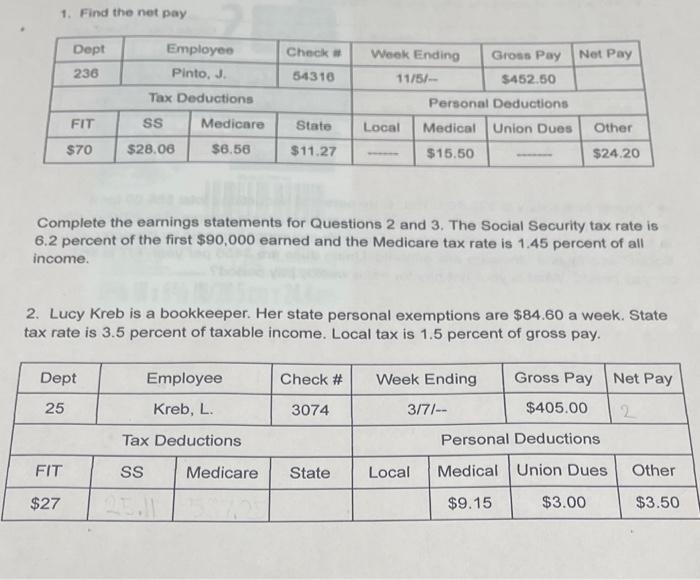

Question: For #1 Find the net pay Complete the earnings statement for #2 1. Find the net pay Dept Employee Pinto, J. Tax Deductions Check 54316

1. Find the net pay Dept Employee Pinto, J. Tax Deductions Check 54316 236 Week Ending Gross Pay Net Pay 11/5/- $452.50 Personal Deductions Local Medical Union Dues Other $15.50 $24.20 FIT SS Medicare State $70 $28.00 $6.50 $11.27 Complete the earnings statements for Questions 2 and 3. The Social Security tax rate is 6.2 percent of the first $90,000 earned and the Medicare tax rate is 1.45 percent of all income. 2. Lucy Kreb is a bookkeeper. Her state personal exemptions are $84.60 a week. State tax rate is 3.5 percent of taxable income. Local tax is 1.5 percent of gross pay. Dept Employee Check # Net Pay 25 Kreb, L. 3074 Week Ending Gross Pay 3/7/-- $405.00 Personal Deductions 2. Tax Deductions FIT SS Medicare State Local Medical Union Dues Other $27 $9.15 $3.00 $3.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts