Question: For a given stock, the stated P/E (ttm) is much higher than the stated Forward P/E. The most likely explanation is: The share price is

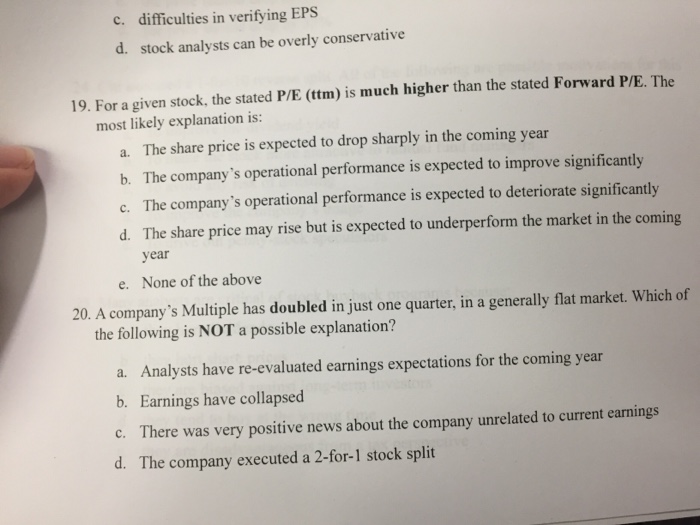

For a given stock, the stated P/E (ttm) is much higher than the stated Forward P/E. The most likely explanation is: The share price is expected to drop sharply in the coming year The company's operational performance is expected to improve significantly The company's operational performance is expected to deteriorate significantly The share price may rise but is expected to underperform the market in the coming year None of the above A company's Multiple has doubled in just one quarter, in a generally flat market. Which of the following is NOT a possible explanation? Analysts have re-evaluated earnings expectations for the coming year Earnings have collapsed There was very positive news about the company unrelated to current earnings The company executed a 2-for-1 stock split

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts