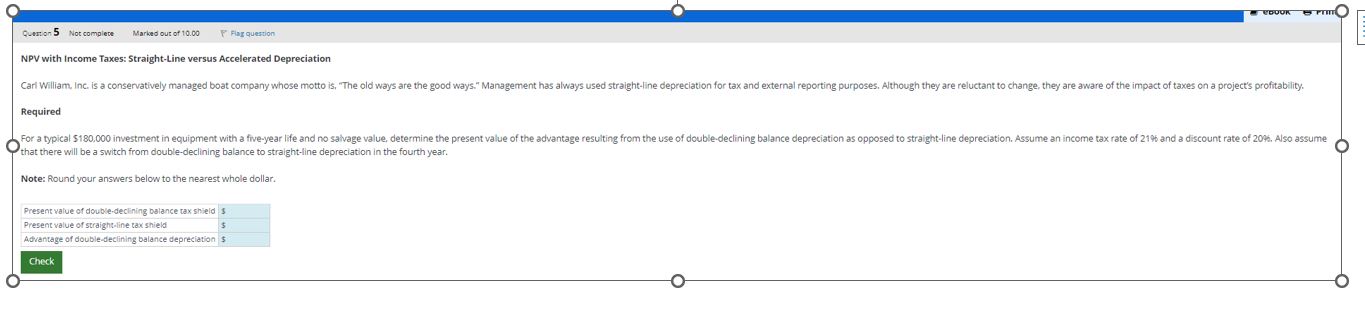

Question: For a typical 1 8 0 , 0 0 0 investment in equipment with a five yar life and no salvage value, determine the present

For a typical investment in equipment with a five yar life and no salvage value, determine the present value of the advantage resulting from the use of doubledeclining depreciation as opposed to straightline depreciation. Assume income tax rate of and a discount rate of Thre will be a switch from doubledeclining balance to straightline depreciation in the fourth year. Calculate the preesent value of doubledeclining balance tax shield. Quation Not complece Markes our of P Hag quession NPV with Income Taxes: StraightLine versus Accelerated Depreciation Required that there will be a switch from doubledeclining balance to straightline depreciation in the fourth year.

Note: Round your answers below to the nearest whole dollar.

Present value of double.decining dalance tax shield

Present value of straightsline tax shieb

Adrantage of doubledeclining balance depreciation $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock