Question: For all call and put options, answer questions based on per share price, per share premium, and etc. Please be aware that the first question

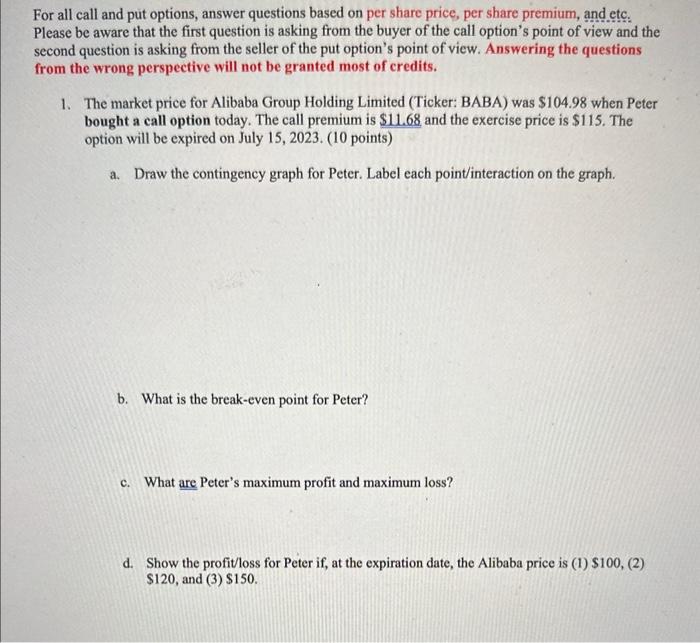

For all call and put options, answer questions based on per share price, per share premium, and etc. Please be aware that the first question is asking from the buyer of the call option's point of view and the second question is asking from the seller of the put option's point of view. Answering the questions from the wrong perspective will not be granted most of credits. 1. The market price for Alibaba Group Holding Limited (Ticker: BABA) was $104.98 when Peter bought a call option today. The call premium is $11.68 and the exercise price is $115. The option will be expired on July 15, 2023. (10 points) a. Draw the contingency graph for Peter. Label each point/interaction on the graph. b. What is the break-even point for Peter? c. What are Peter's maximum profit and maximum loss? d. Show the profit/oss for Peter if, at the expiration date, the Alibaba price is (1) $100, (2) $120, and (3) \$150

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts