Question: For all questions, answer them based on per share price, per share premium, and etc. 2. You purchased Netflix at $140.71/share in 2017. Now, Netflix

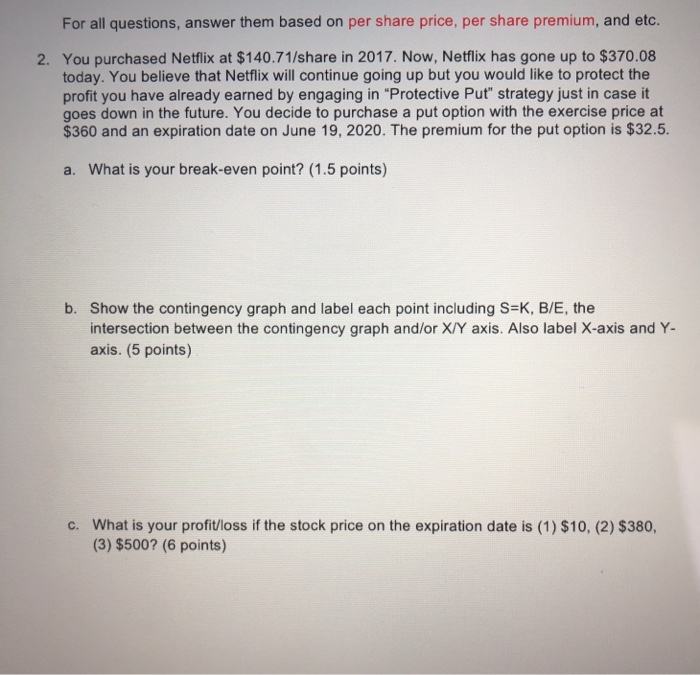

For all questions, answer them based on per share price, per share premium, and etc. 2. You purchased Netflix at $140.71/share in 2017. Now, Netflix has gone up to $370.08 today. You believe that Netflix will continue going up but you would like to protect the profit you have already earned by engaging in "Protective Put" strategy just in case it goes down in the future. You decide to purchase a put option with the exercise price at $360 and an expiration date on June 19, 2020. The premium for the put option is $32.5. a. What is your break-even point? (1.5 points) b. Show the contingency graph and label each point including S=K, B/E, the intersection between the contingency graph and/or X/Y axis. Also label X-axis and Y- axis. (5 points) c. What is your profit/loss if the stock price on the expiration date is (1) $10, (2) $380, (3) $500? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts