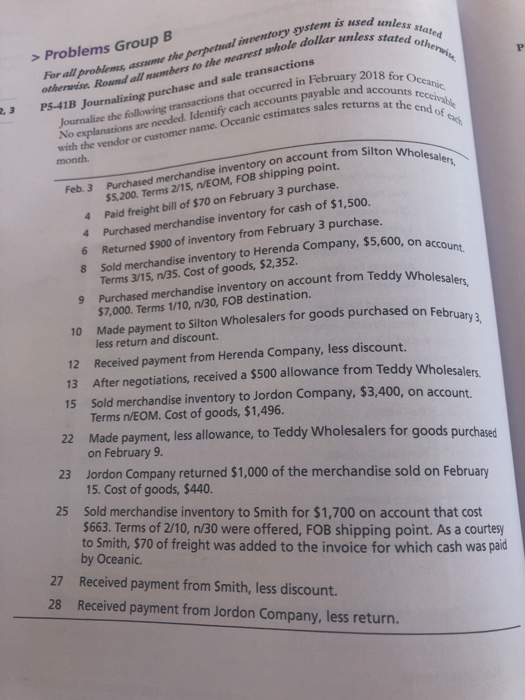

Question: For all problems assume the perpetual inventory system is used. othervise Round all numbers to the nearest whole dollar unless ess > Problems Group B

For all problems assume the perpetual inventory system is used. othervise Round all numbers to the nearest whole dollar unless ess > Problems Group B stated otl ed otherwise, Journalize the following transactions that occurred in February 201 No P5-41B Journalizing purchase and sale transactions at the end of eyplanations are needed. Identify each accounts payable and wrth the vendor or customer name. Occanic estimates sales returns counts tei month. ed merchandise inventory on account from Paid freight bill of $70 on February 3 purchase 4 Purchased merchandise inventory for cash of $1,500 6 Returned $900 of inventory from February 3 purchase. $5,200. Terms 2/15, nVEOM, FOB shipping point. 4 8 Sold merchandise inventory to Herenda Company, $5,600, on accou nt. Terms 3/15, n/35. Cost of goods, $2,352. Wholesalers Purchased merchandise inventory on account from Teddy Who rdestiatios purchased on February a 9 $7,000. Terms 1/10, n/30, FOB destination. Made payment to Silton Wholesalers for goods purchased on F less return and discount. 10 Received payment from Herenda Company, less discount. 12 13 After negotiations, received a $500 allowance from Teddy Wholesaler 15 Sold merchandise inventory to Jordon Company, $3,400, on account Terms n/EOM. Cost of goods, $1,496. Made payment, less allowance, to Te on February 9. Jordon Company returned $1,000 of the merchandise sold on February 15. Cost of goods, $440. Sold merchandise inventory to Smith for $1,700 on account that cost $663. Terms of 2/10, n/30 were offered, FOB shipping point. As a courtes to Smith, $70 of freight was added to the invoice for which cash was paid 22 ddy Wholesalers for goods purchased 23 25 by Oceanic. 27 Received payment from Smith, less discount. 28 Received payment from Jordon Company, less return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts