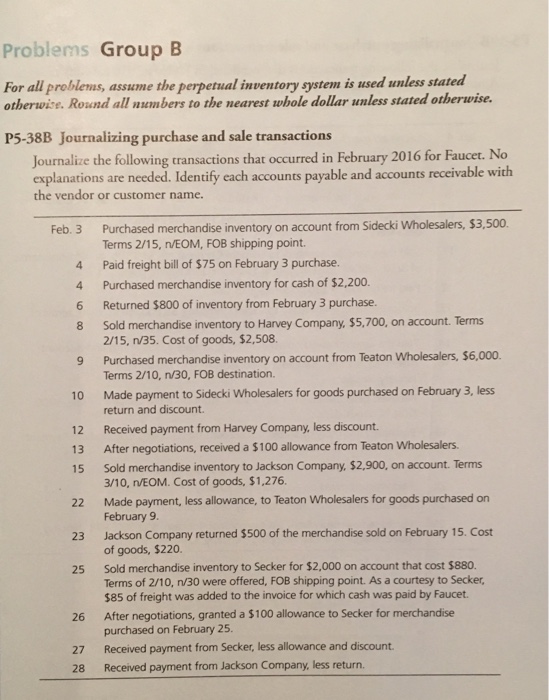

Question: Problems Group B For all problems, assume the perpetual inventory system is used unless stated otherwise. Round all numbers to the nearest whole dollar unless

Problems Group B For all problems, assume the perpetual inventory system is used unless stated otherwise. Round all numbers to the nearest whole dollar unless stated otherwise. P5-38B Journalizing purchase and sale transactions Journalize the following transactions that occurred in February 2016 for Faucet. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Feb. 3 Purchased merchandise inventory on account from Sidecki wholesalers, $3,500 Terms 2/15, n/EOM, FOB shipping point. 4 Paid freight bill of $75 on February 3 purchase. 4 Purchased merchandise inventory for cash of $2,200. 6 Returned $800 of inventory from February 3 purchase. 8 Sold merchandise inventory to Harvey Company, $5.700, on account. Terms 2/15. n/35. Cost of goods, $2,508. 9 Purchased merchandise inventory on account from Teaton Wholesalers, $6,000. Terms 2/10, n/30, FOB destination. 10 Made payment to Sidecki wholesalers for goods purchased on February 3, less return and discount. 12 Received payment from Harvey company less discount. 13 After negotiations, received a $100 allowance from Teaton Wholesalers. 15 Sold merchandise inventory to Jackson Company, $2,900, on account. Terms 3/10, nVEOM. Cost of goods, $1,276. 22 Made payment, less allowance, to Teaton Wholesalers for goods purchased on February 9 23 Jackson Company returned $500 of the merchandise sold on February 15. Cost of goods, $220. 25 Sold merchandise inventory to Secker for $2,000 on account that cost $880. Terms of 2/10, n/30 were offered, FOB shipping point. As a courtesy to Secker, $85 of freight was added to the invoice for which cash was paid by Faucet. 26 After negotiations, granted a $100 allowance to Secker for merchandise purchased on February 25 27 Received payment from Secker, less allowance and discount. 28 Received payment from Jackson Company, less return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts