Question: For all problems where a risk free rate or a dividend yield is given, assume that the interest rate and the dividend yield are annual

For all problems where a risk free rate or a dividend yield is given, assume that the interest rate and the dividend yield are annual and continuously compounded rates.

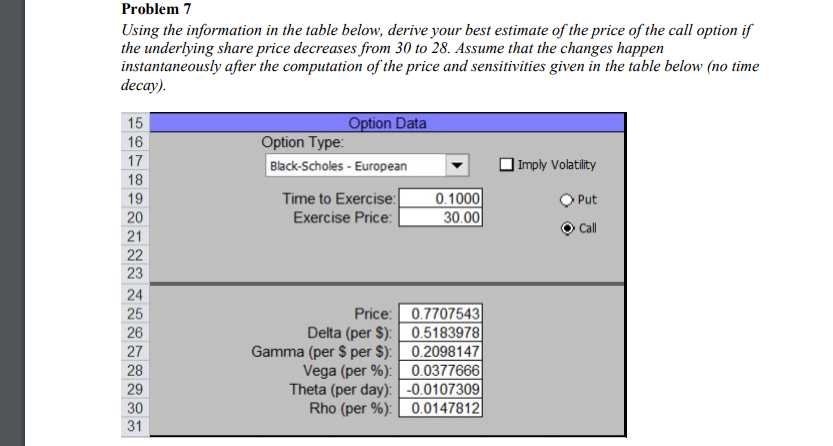

Problem 7

Using the information in the table below, derive your best estimate of the price of the call option if the underlying share price decreases from 30 to 28. Assume that the changes happen instantaneously after the computation of the price and sensitivities given in the table below (no time decay).

Problem 7 Using the information in the table below, derive your best estimate of the price of the call option if the underlying share price decreases from 30 to 28. Assume that the changes happen instantaneously after the computation of the price and sensitivities given in the table below (no time decay). Option Data Option Type: Black-Scholes - European Time to Exercise: 0.1000 Exercise Price: 30.00 | Imply Volatility 15 16 17 18 19 20 21 22 23 24 Put Call 25 26 27 28 29 30 31 Price: 0.7707543 Delta (per $): 0.5183978 Gamma (per $ per $): 0.2098147 Vega (per %): 0.0377666 Theta (per day): -0.0107309 Rho (per %): 0.0147812

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts