Question: For all problems where a risk free rate or a dividend yield is given, assume that the interest rate and the dividend yield are annual

For all problems where a risk free rate or a dividend yield is given, assume that the interest rate and the dividend yield are annual and continuously compounded rates.

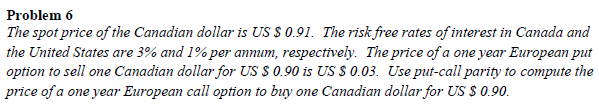

Problem 6 The spot price of the Canadian dollar is US S 0.91. The risk free rates of interest in Canada and the United States are 3% and 1% per annum, respectively. The price of a one year European put option to sell one Canadian dollar for US $ 0.90 is US $ 0.03. Use put-call parity to compute the price of a one year European call option to buy one Canadian dollar for US $0.90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts