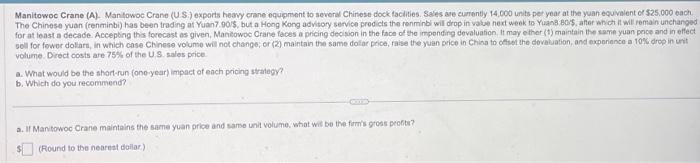

Question: for at least a decade. Accepting ths forecast as given, Manilowoc Crane faces a pricing decison in the face of the impending devaluation. It may

for at least a decade. Accepting ths forecast as given, Manilowoc Crane faces a pricing decison in the face of the impending devaluation. It may ether (1) maintain the same yuan poce and in effect gell for fowor dolarn, in which case. Chinese volume wil not change; or (2) maintain the same dolar price, faise the yuan price in China to chivot the dovaluatian, and experiance a 10\%, drep in unt volume. Diect costs are 75% of the U.S. sales price a. What would bo the short-run (ono-year) impact of each pricing strategr? b. Which do you recommend? a. If Mantowoc Crane maintains the same yuan price and same unit volume, what wis be the furm's groas profte? (Round to the nearnst doilar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts