Question: ) For each item below, FIFO is preferable in times of rising prices and LIFO will generally result in a higher reported amount when inventory

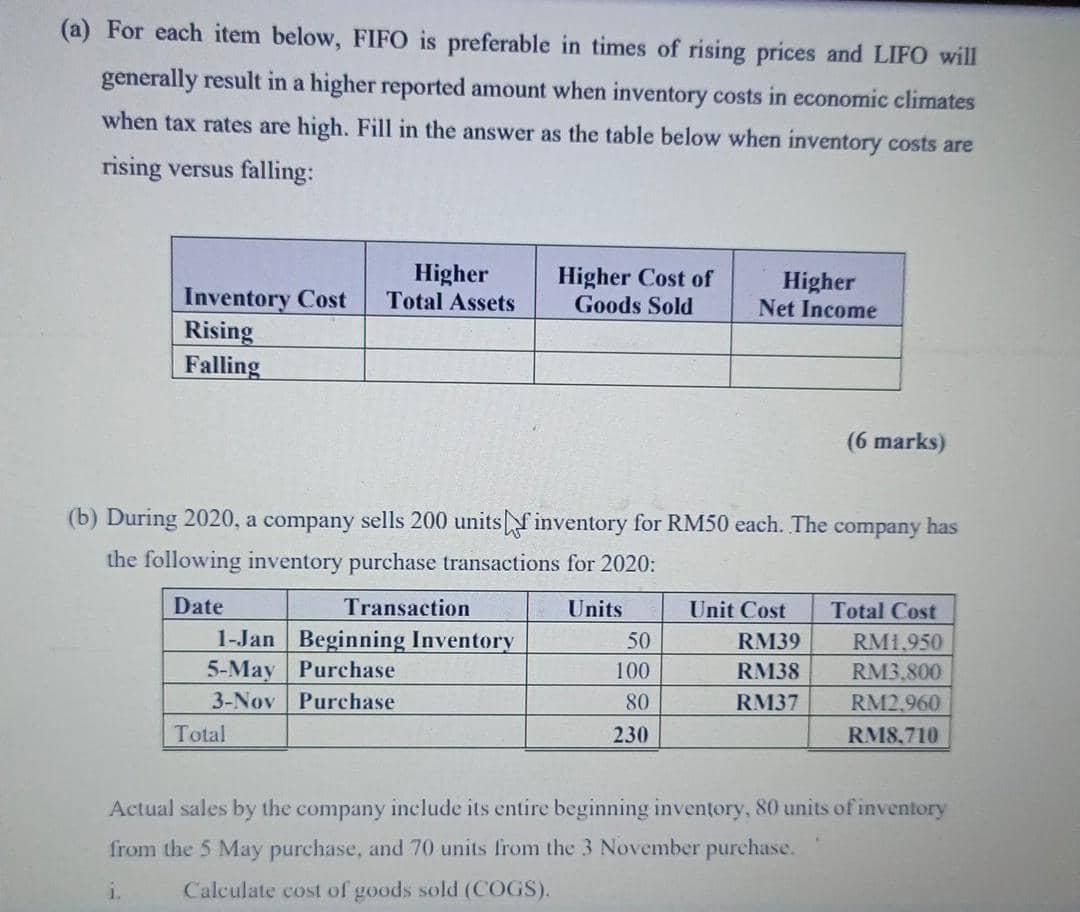

) For each item below, FIFO is preferable in times of rising prices and LIFO will generally result in a higher reported amount when inventory costs in economic climates when tax rates are high. Fill in the answer as the table below when inventory costs are rising versus falling: (6 marks) (

b) During 2020, a company sells 200 units of inventory for RM50 each. The company has the following inventory purchase transactions for 2020: Date Transaction Units Unit Cost Total Cost 1-Jan Beginning Inventory 50 RM39 RM1,950 5-May Purchase 100 RM38 RM3,800 3-Nov Purchase 80 RM37 RM2,960 Total 230 RM8,710 Actual sales by the company include its entire beginning inventory, 80 units of inventory from the 5 May purchase, and 70 units from the 3 November purchase.

i. Calculate cost of goods sold (COGS). (8 marks) Assuming the company uses specific identification with May purchase 20 units and November 10 units.

ii. Calculate ending inventory for 2020.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts