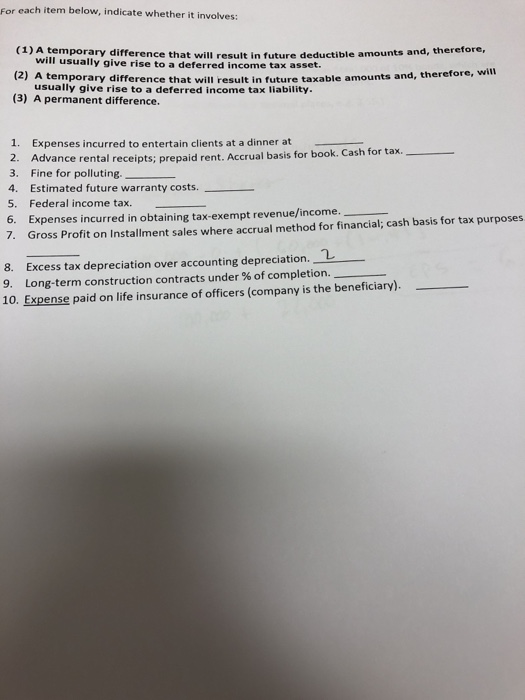

Question: For each item below, indicate whether it involves: (1) A temporary difference that will result in future deductible amounts and, therefore, will usually give rise

For each item below, indicate whether it involves: (1) A temporary difference that will result in future deductible amounts and, therefore, will usually give rise to a deferred income tax asset. ll (2) A temporary difference that will result in future taxable amounts and, therefore, w (3) A permanent difference usually give rise to a deferred income tax liability. 1. Expenses incurred to entertain clients at a dinner at 2. Advance rental receipts; prepaid rent. Accrual basis for book. Cash fort 3. Fine for polluting. 4. Estimated future warranty costs. 5. Federal income tax. 6. Ex penses incurred in obtaining tax-exempt revenue/income. Gross Profit on Installment sales where accrual method for financial; cash basis for tax purposes 7. 8. Excess tax depreciation over accounting depreciation 9, Long-term construction contracts under % of completion. 10. Expense paid on life insurance of officers (company is the beneficiary)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts