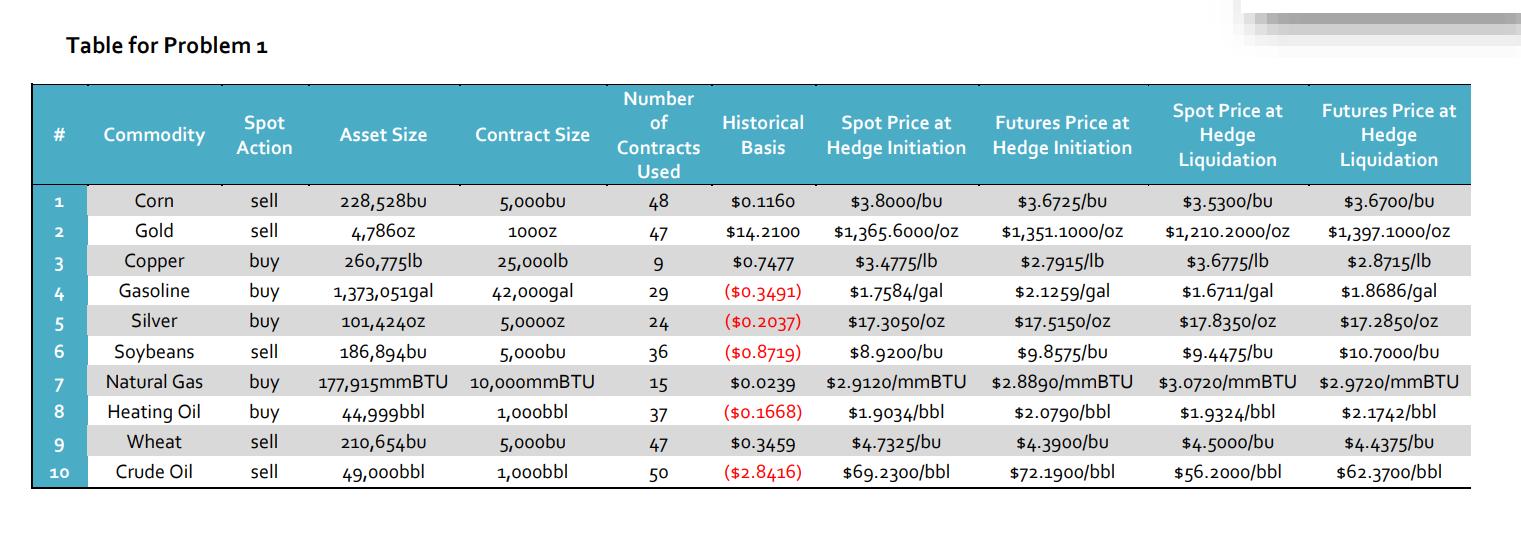

Question: For each scenario in the table: identify the position the hedger should take (long or short) identify the target price the hedger would

For each scenario in the table:

• identify the position the hedger should take (long or short)

• identify the target price the hedger would expect to receive/pay for the hedged commodity

• calculate the hedge ratio used by the hedger

• calculate the effective net price received or paid for the asset at hedge liquidation

• determine the basis at the initiation and closing of futures position

• explain why the target price and the actual (effective net) price are different Round your results to four decimal places

Table for Problem 1 # 1 2 3 4 5 6 7 8 9 10 Commodity Corn Gold Copper Gasoline Silver Soybeans Natural Gas Heating Oil Wheat Crude Oil Spot Action sell sell Asset Size 228,528bu 4,7860z buy 260,775lb buy 1,373,051gal buy 101,4240Z sell 186,894bu 177,915mmBTU 44,999bbl 210,654bu 49,000bbl buy buy sell sell Contract Size 5,000bu 1000Z 25,000lb 42,000gal 5,00002 5,000bu 10,000mmBTU 1,000bbl 5,000bu 1,000bbl Number of Contracts Used 48 47 9 29 24 36 15 37 47 50 Historical Basis Spot Price at Hedge Initiation Futures Price at Hedge Initiation Spot Price at Hedge Liquidation $0.1160 $3.8000/bu $1,365.6000/oz $3.4775/lb $14.2100 $0.7477 ($0.3491) $3.6725/bu $1,351.1000/oz $2.7915/lb $3.5300/bu $1,210.2000/oz $3.6775/lb $1.7584/gal $2.1259/gal $1.6711/gal ($0.2037) $17.3050/0z $17.5150/02 $17.8350/0z $9.8575/bu $9.4475/bu ($0.8719) $8.9200/bu $0.0239 $2.9120/mmBTU $2.8890/mmBTU $3.0720/mmBTU $2.0790/bbl $1.9324/bbl ($0.1668) $0.3459 ($2.8416) $1.9034/bbl $4.7325/bu $4.3900/bu $4.5000/bu $69.2300/bbl $72.1900/bbl $56.2000/bbl Futures Price at Hedge Liquidation $3.6700/bu $1,397.1000/oz $2.8715/lb $1.8686/gal $17.2850/0z $10.7000/bu $2.9720/mmBTU $2.1742/bbl $4.4375/bu $62.3700/bbl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts