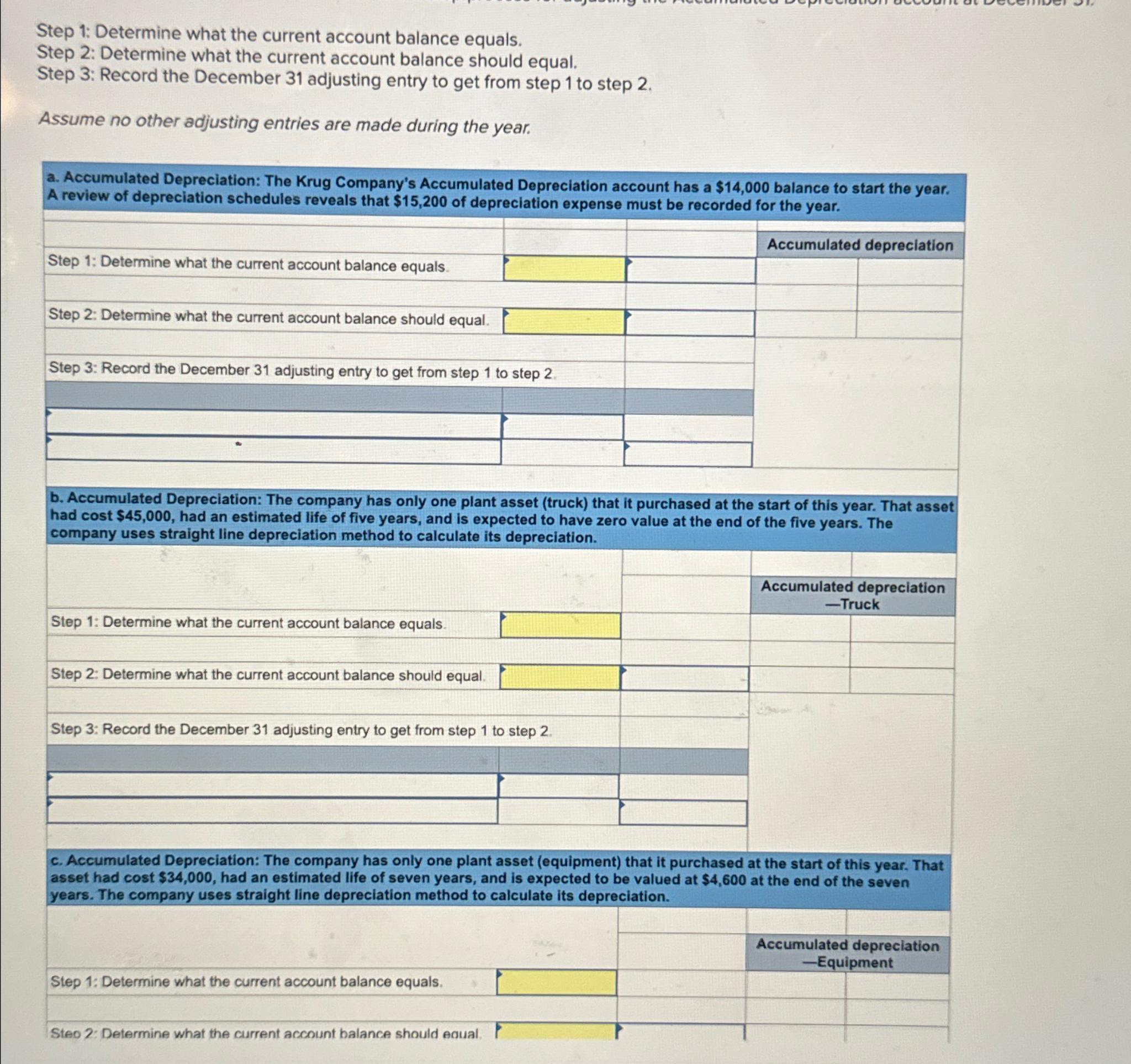

Question: For each separate case below, follow the three - step process for adjusting the Accumulated Depreciation account at December 3 1 . Step 1 :

For each separate case below, follow the threestep process for adjusting the Accumulated Depreciation account at December

Step : Determine what the current account balance equals.

Step : Determine what the current account balance should equal.

Step : Record the December adjusting entry to get from step to step

Assume no other adjusting entries are made during the year.

a Accumulated Depreciation: The Krug Company's Accumulated Depreciation account has a $ balance to start the year.

A review of depreciation schedules reveals that $ of depreciation expense must be recorded for the year.

tableStep : Determine what the current account balance equals.,,Step : Determine what the current account balance should equal.,,Step : Record the December adjusting entry to get from step to step

b Accumulated Depreciation: The company has only one plant asset truck that it purchased at the start of this year. That asset had cost $ had an estimated life of five years, and is expected to have zero value at the end of the five years. The company uses straight line depreciation method to calculate its depreciation.

tableStep : Determine what the current account balance equals.,tableAccumulated depreciationTruckStep : Determine what the current account balance should equal.,,Step : Record the December adjusting entry to get from step to step

c Accumulated Depreciation: The company has only one plant asset equipment that it purchased at the start of this year. That asset had cost $ had an estimated life of seven years, and is expected to be valued at $ at the end of the seven years. The company uses straight line depreciation method to calculate its depreciation.

tableStep : Determine what the current account balance equals.,,tableAccumulated depreciationEquipmentSteo : Determine what the current account balance should eoual.,,

Step : Record the December adjusting entry to get from step to step

b Accumulated Depreciation: The company has only one plant asset truck that it purchased at the start of this year. That asset had cost $ had an estimated life of five years, and is expected to have zero value at the end of the five years. The company uses straight line depreciation method to calculate its depreciation.

tableStep : Determine what the current account balance equals.,Accumulated depreciationStep : Determine what the current account balance should equal.,Step : Record the December adjusting entry to get from step to step

asset had cost $ had an estimated life of seven years, and is expected to be valued at $ at the end of the seven years. The company uses straight line depreciation method to calculate its depreciation.

tableStep : Determine what the current account balance equals.,,Accumulated depreciationStep : Determine what the current account balance should equal.,,

Step : Determine what the current account balance equals.

Step : Determine what the current account balance should equal.

Step : Record the December adjusting entry to get from step to step

Assume no other adjusting entries are made during the year.

a Accumulated Depreciation: The Krug Company's Accumulated Depreciation account has a $ balance to start the year. A review of depreciation schedules reveals that $ of depreciation expense must be recorded for the year.

tableStep : Determine what the current account balance equals.,,Accumulated depreciationStep : Determine what the current account balance should equal.,,Step : Record the December adjusting entry to get from step to step

b Accumulated Depreciation: The company has only one plant asset truck that it purchased at the start of this year. That asset had cost $ had an estimated life of five years, and is expected to have zero value at the end of the five years. The company uses straight line depreciation method to calculate its depreciation.

tableStep : Determine what the current account balance equals.,,Step : Determine what the current account balance should equal.,,tableAccumulated depreciationTruckStep : Record the December adjusting entry to get from step to step

c Accumulated Depreciation: The company has only one plant asset equipment that it purchased at the start of this year. That years. The company uses straight line depreciation method to calculate its depreciation.

tableStep : Determine what the curr

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock