Question: For each separate case below, follow the three-step process for adjusting the Accumulated Depreciation account at December 31. Step 1: Determine what the current account

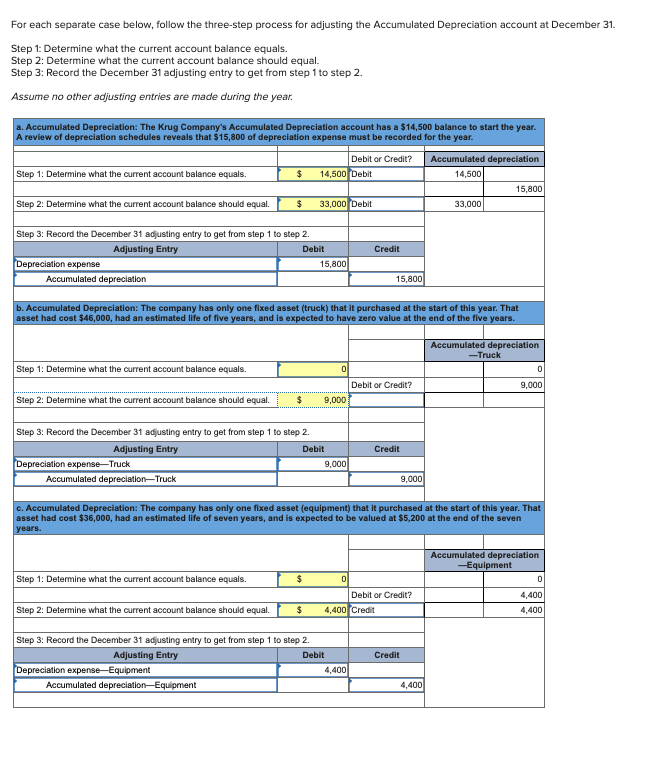

For each separate case below, follow the three-step process for adjusting the Accumulated Depreciation account at December 31. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year. a. Accumulated Depreciation: The Krug Company's Accumulated Depreciation account has a $14,500 balance to start the year. A review of depreciation schedules reveals that $15,800 of depreciation expense must be recorded for the year. Debitor Credit? Accumulated depreciation Step 1: Determine what the current account balance equals. $ 14,500 Debit 14,500 15,800 Step 2: Determine what the current account balance should equal. $ 33,000 Debit 33,000 Credit Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Adjusting Entry Debit Depreciation expense 15,800 Accumulated depreciation 15,800 b. Accumulated Depreciation: The company has only one fixed asset (truck) that it purchased at the start of this year. That asset had cost $46,000, had an estimated life of five years, and is expected to have zero value at the end of the five years. Accumulated depreciation -Truck 0 Step 1: Determine what the current account balance equals. Debitor Credit? 9,000 Step 2: Determine what the current account balance should equal. $ 9,000 Credit Step 3. Record the December 31 adjusting entry to get from step 1 to step 2. Adjusting Entry Debit Depreciation expense-Truck 9,000 Accumulated depreciation-Truck 9,000 c. Accumulated Depreciation: The company has only one fixed asset (equipment) that it purchased at the start of this year. That asset had cost $36,000, had an estimated life of seven years, and is expected to be valued at $5,200 at the end of the seven years. Accumulated depreciation Equipment 0 Step 1: Determine what the current account balance equals. $ 0 Debitor Credit? 4,400 Credit 4,400 4,400 Step 2: Determine what the current account balance should equal. $ Credit Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Adjusting Entry Debit Depreciation expense-Equipment 4,400 Accumulated depreciation Equipment 4,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts