Question: For each separate case, record an adjusting entry (if necessary). a Lonzo co receives $6,000 cash in advance for six months of sustainable recycling services

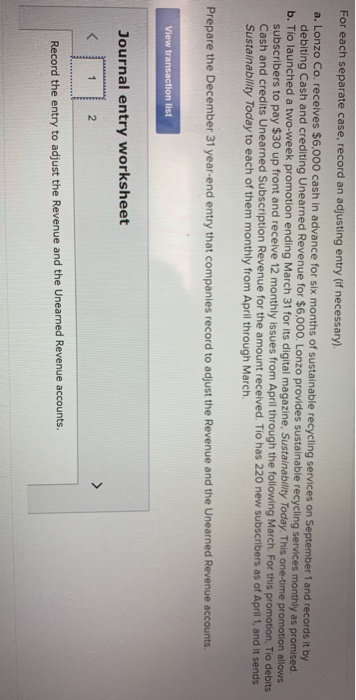

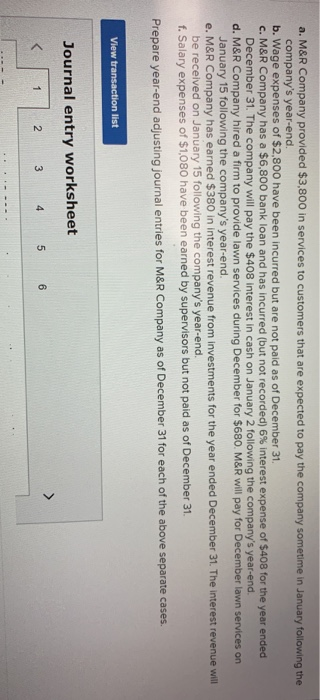

For each separate case, record an adjusting entry (if necessary). a Lonzo co receives $6,000 cash in advance for six months of sustainable recycling services on September and records it by debiting Cash and crediting Unearned Revenue for $6,000. Lonzo provides sustainable recycling services monthly as promised b. Tio launched a two-week promotion ending March 31 for its digital magazine, Sustainability Today. This one-time promotion allows subscribers to pay $30 up front and receive 12 monthly issues from April through the following March. For this promotion, Tio debits Cash and credits Unearned Subscription Revenue for the amount received. To has 220 new subscribers as of April 1, and it sends Sustainability Today to each of them monthly from April through March Prepare the December 31 year-end entry that companies record to adjust the Revenue and the Unearned Revenue accounts View transaction list Journal entry worksheet Record the entry to adjust the Revenue and the Unearned Revenue accounts. a. M&R Company provided $3,800 in services to customers that are expected to pay the company sometime in January following the company's year-end. b. Wage expenses of $2,800 have been incurred but are not paid as of December 31. c. M&R Company has a $6,800 bank loan and has incurred (but not recorded) 6% interest expense of $408 for the year ended December 31. The company will pay the $408 interest in cash on January 2 following the company's year-end d. M&R Company hired a firm to provide lawn services during December for $680. M&R will pay for December lawn services on January 15 following the company's year-end. e. M&R Company has earned $380 in interest revenue from investments for the year ended December 31. The interest revenue will be received on January 15 following the company's year-end. f. Salary expenses of $1,080 have been earned by supervisors but not paid as of December 31 Prepare year-end adjusting journal entries for M&R Company as of December 31 for each of the above separate cases. View transaction list Journal entry worksheet 2 3 4 5 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts