Question: For each separate case, record an adjusting entry (if necessary). a. Lonzo Company receives $3,600 cash in advance for six months of recycling services on

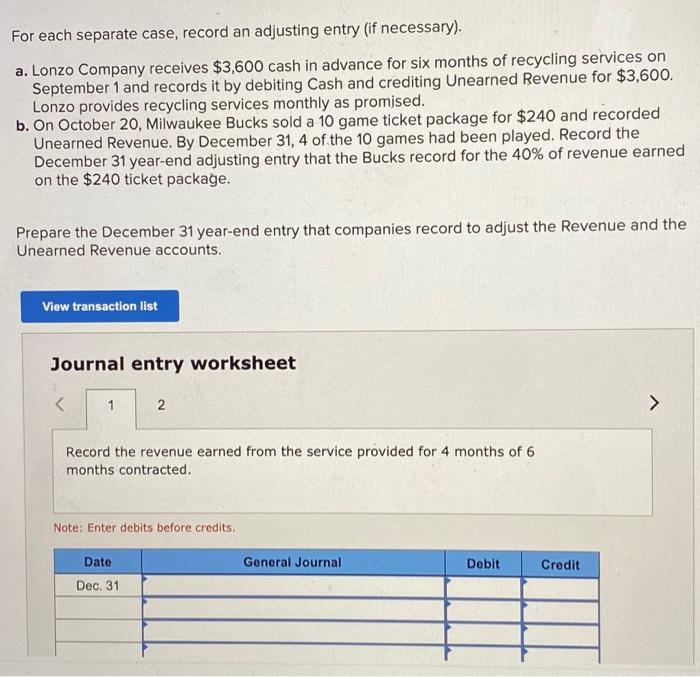

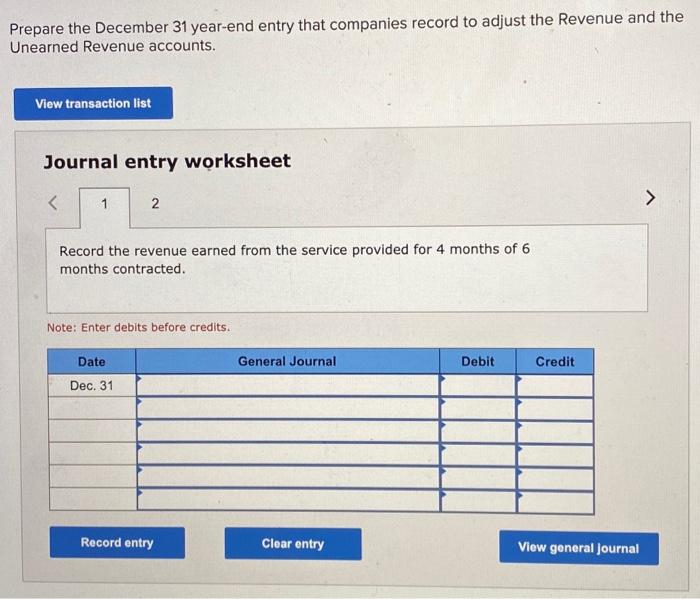

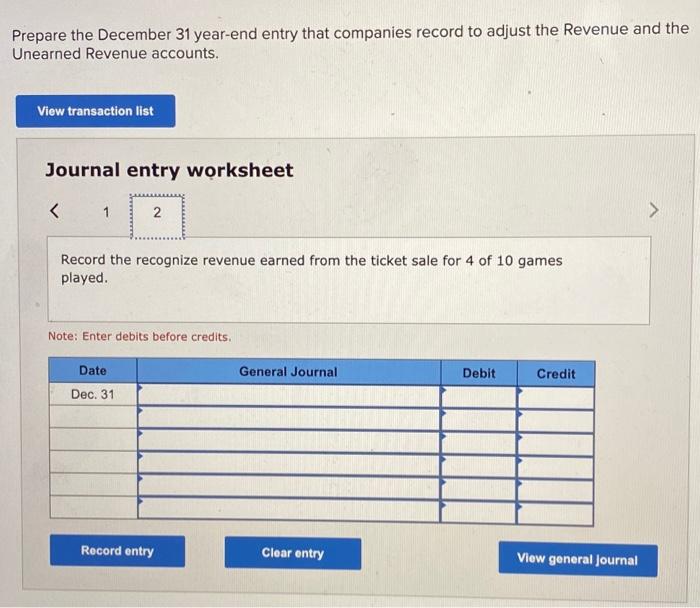

For each separate case, record an adjusting entry (if necessary). a. Lonzo Company receives $3,600 cash in advance for six months of recycling services on September 1 and records it by debiting Cash and crediting Unearned Revenue for $3,600. Lonzo provides recycling services monthly as promised. b. On October 20, Milwaukee Bucks sold a 10 game ticket package for $240 and recorded Unearned Revenue. By December 31, 4 of the 10 games had been played. Record the December 31 year-end adjusting entry that the Bucks record for the 40% of revenue earned on the $240 ticket package. Prepare the December 31 year-end entry that companies record to adjust the Revenue and the Unearned Revenue accounts. View transaction list Journal entry worksheet Record the revenue earned from the service provided for 4 months of 6 months contracted. Note: Enter debits before credits. Date General Journal Debit Credit Dec. 31 Record entry Clear entry View general Journal Prepare the December 31 year-end entry that companies record to adjust the Revenue and the Unearned Revenue accounts. View transaction list Journal entry worksheet Record the recognize revenue earned from the ticket sale for 4 of 10 games played. Note: Enter debits before credits. General Journal Debit Credit Date Dec. 31 Record entry Clear entry View general Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts