Question: For each statement you answer, insert T or F in the appropriate space on the separate answer sheet. 1. 2. 3. 4. 5. 6. 7.

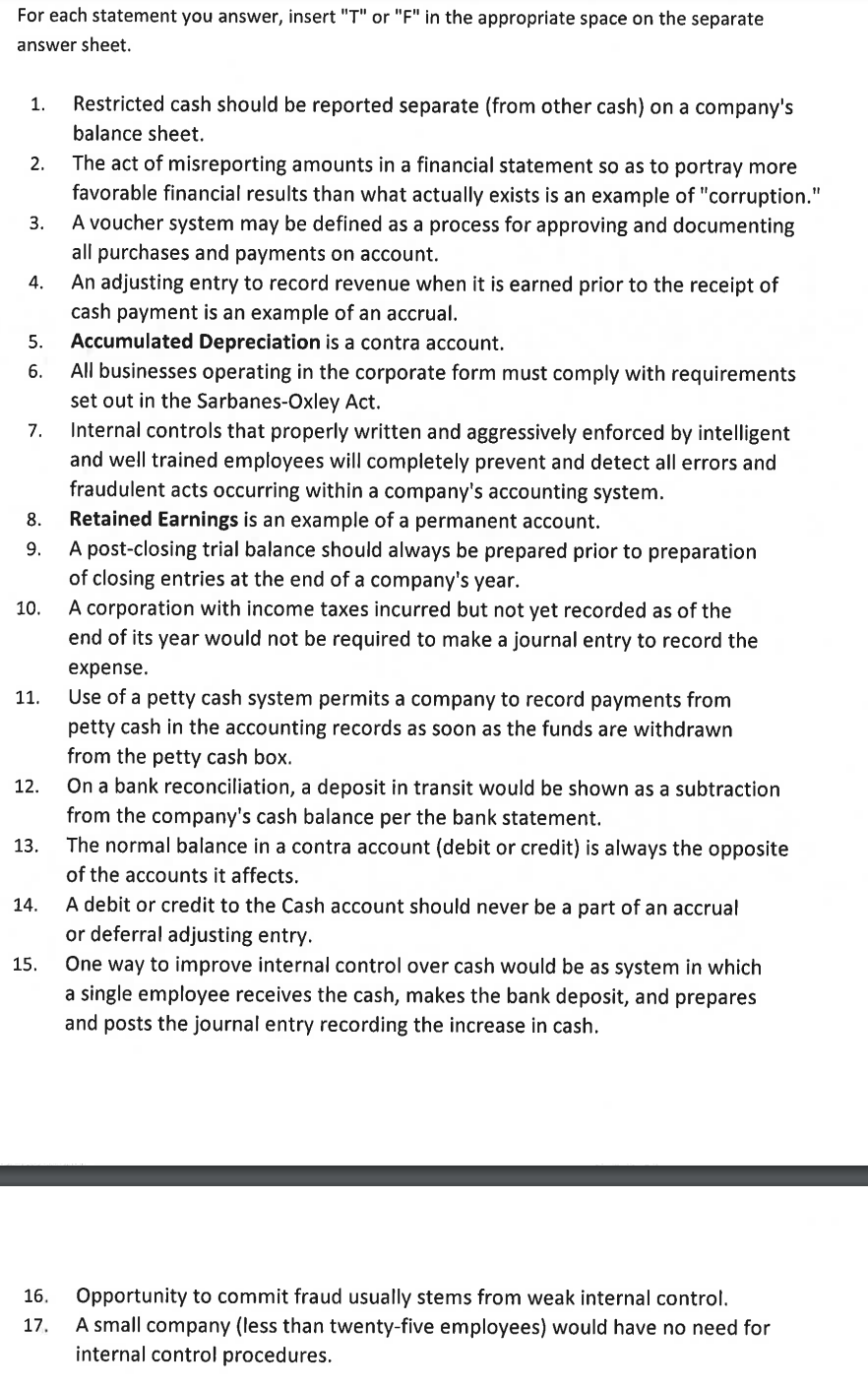

For each statement you answer, insert "T" or "F" in the appropriate space on the separate answer sheet. 1. 2. 3. 4. 5. 6. 7. 8. 9. Restricted cash should be reported separate (from other cash) on a company's balance sheet. The act of misreporting amounts in a financial statement so as to portray more favorable financial results than what actually exists is an example of "corruption." A voucher system may be defined as a process for approving and documenting all purchases and payments on account. An adjusting entry to record revenue when it is earned prior to the receipt of cash payment is an example of an accrual. Accumulated Depreciation is a contra account. All businesses operating in the corporate form must comply with requirements set out in the Sarbanes-Oxley Act. Internal controls that properly written and aggressively enforced by intelligent and well trained employees will completely prevent and detect all errors and fraudulent acts occurring within a company's accounting system. Retained Earnings is an example of a permanent account. A post-closing trial balance should always be prepared prior to preparation of closing entries at the end of a company's year. A corporation with income taxes incurred but not yet recorded as of the end of its year would not be required to make a journal entry to record the expense. Use of a petty cash system permits a company to record payments from petty cash in the accounting records as soon as the funds are withdrawn from the petty cash box. On a bank reconciliation, a deposit in transit would be shown as a subtraction from the company's cash balance per the bank statement. The normal balance in a contra account (debit or credit) is always the opposite of the accounts it affects. A debit or credit to the Cash account should never be a part of an accrual or deferral adjusting entry. One way to improve internal control over cash would be as system in which a single employee receives the cash, makes the bank deposit, and prepares and posts the journal entry recording the increase in cash. 10. 11. 12. 13. 14. 15. 16. 17. Opportunity to commit fraud usually stems from weak internal control. A small company (less than twenty-five employees) would have no need for internal control procedures

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts